In what could be a first for Tesla (NASDAQ:TSLA), its market share in the U.S. for electric vehicles fell marginally below 50% in the calendar second quarter, despite record sales of battery-powered cars, according to a report by Cox Automotive. This report stated that Tesla’s market share dropped to 49.7% from 59.3% a year earlier. The EV major lost ground to General Motors (NYSE:GM) and Ford (NYSE:F).

Overall, sales of EVs in the U.S. climbed 11.3% year-over-year. Cox estimates that the company’s sales in the U.S. fell by 6.3% year-over-year in the second quarter to 164,000 vehicles. Tesla’s Q2 vehicle deliveries globally came in at 443,956, a decline of 4.8% year-over-year but above consensus estimates of 436,000 vehicles.

In the first quarter, Tesla sold 140,000 EVs, while Ford sold 20,000 EVs. Tesla’s market share in Europe is around 20% and 10% in China.

Tesla Raises Prices of its Cars in Europe

However, it remains to be seen whether Tesla can retain its market share in Europe after the company increased the prices of its Model 3 cars in Europe. The company announced that it has raised the prices of its Model 3 cars in European countries, including Germany, the Netherlands, and Spain, by around €1,500 ($1,622) after the EU imposed tariffs on EVs made in China.

In June, Tesla, which exports many EVs from China, cautioned that it might increase prices. This move was prompted by tariffs imposed by the European Commission to prevent an influx of subsidized EVs.

Morgan Stanely Analyst Remains Bullish on TSLA

Following this report, top-rated Morgan Stanley analyst Adam Jonas reiterated a Buy rating and a price target of $310 on the stock. The analyst’s price target implies an upside potential of 14.6%. The analyst expects that Tesla’s energy business will reach 100GWh in storage deployments by 2028, three years earlier than previously predicted.

Jonas’s valuation of Tesla’s Energy business rose from $36 to $50 per share, bringing its total value to $183 billion. Furthermore, the analyst noted that Tesla’s Energy business, with higher margins than its solar or auto businesses, is benefiting from growing global energy storage demand. However, the analyst lowered his 2030 outlook for EV sales.

Is Tesla a Buy or Sell?

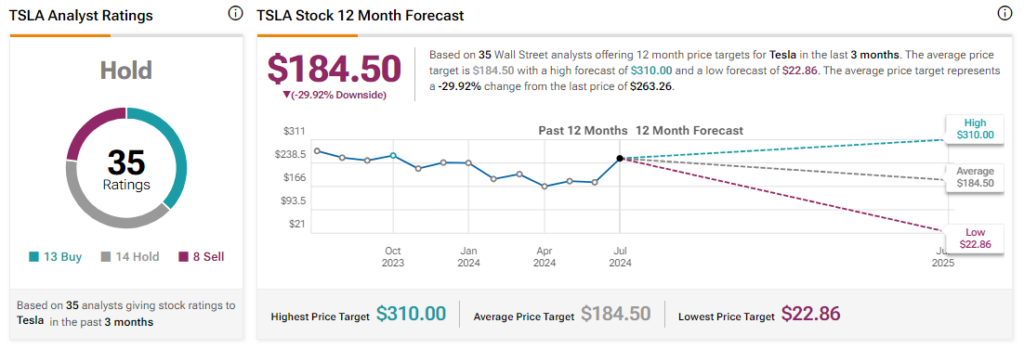

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on 13 Buys, 14 Holds, and eight Sells. Over the past year, TSLA has declined by 2.4%, and the average TSLA price target of $184.50 implies a downside potential of 29.9% from current levels.