Tesla (NASDAQ:TSLA) has filed a lawsuit against Matthews International (NASDAQ:MATW). The Electric Vehicle (EV) leader accuses Matthews of disclosing confidential information to competitors and filing patent applications using Tesla’s proprietary technology without authorization. This legal battle underscores the significant tech and innovation risks inherent in the fiercely competitive EV sector, emphasizing the need to defend and protect intellectual property.

Meanwhile, the lawsuit poses significant challenges for Matthews International, which could hurt its financials and reputation. Moreover, the lawsuit could restrict MATW’s growth by preventing the company from sharing its technology with other players.

MATW is a provider of industrial technologies, including electric vehicle batteries. While Matthews denied the allegations, claiming the lawsuit is baseless, MATW stock closed 7.1% lower on Monday, June 17. Further, it remained in the red in after-hours trading. But before we dig deeper, let’s analyze Tesla’s risk profile.

Tesla’s Risk Analysis

Tesla’s aggressive legal stance highlights the importance of intellectual property in the highly competitive EV market. Protecting its technological advancements is crucial for maintaining market leadership, and this lawsuit focuses on Tesla’s commitment to safeguarding its innovations.

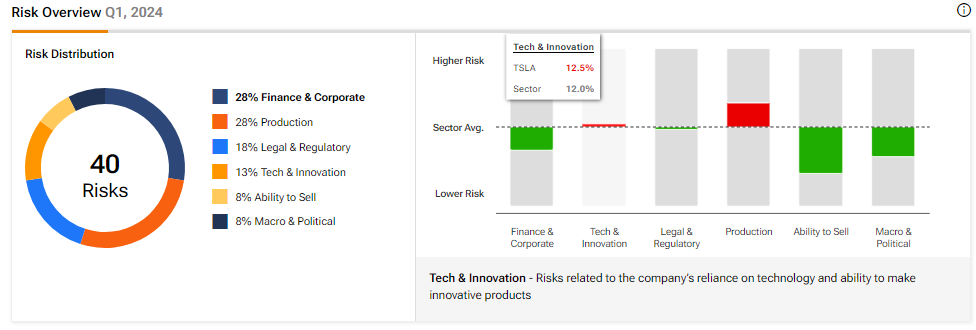

While the outcome of the lawsuit and its implications are still uncertain, Tesla’s exposure to tech and innovation risks is higher than the industry average. According to TipRanks’ Risk Analysis tool, tech & innovation risks account for 12.5% of Tesla’s total risks, compared to the industry average of 12%.

MATW Faces Significant Risks

Matthews engages in licensing agreements with customers, who authorize MATW to use specific intellectual property through various licensing arrangements. However, third-party claims of intellectual property infringement could lead to substantial costs for the company and negatively impact its business, operational performance, and reputation.

Tesla Seeks Over $1B in Damages

The partnership between Tesla and Matthews began in 2019. Matthews supplies equipment essential to refining Tesla’s dry-electrode-battery manufacturing process and scaling it for mass production.

Tesla asserts that Matthews’s actions have caused significant harm and, unless halted, will lead to immediate and irreparable damage. Tesla seeks damages exceeding $1 billion, citing the misuse of confidential information critical to the dry electrode battery technology.

Is Tesla a Buy or Sell?

Tesla stock is down about 25% year-to-date, underperforming the broader markets. This decline reflects the slowdown in EV demand and growing competition.

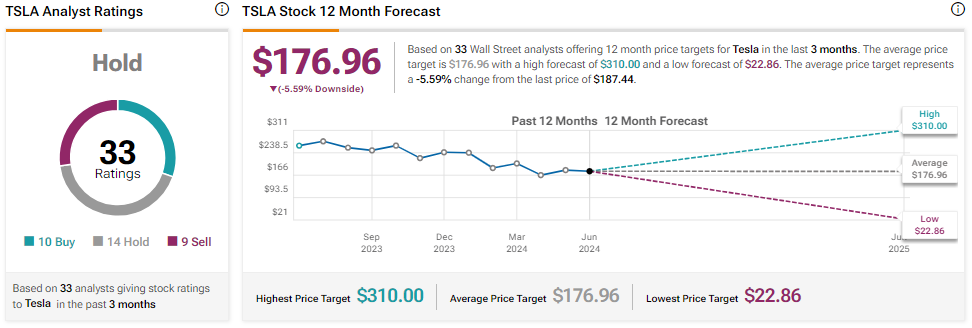

Tesla stock has a Hold consensus rating based on 10 Buys, 14 Holds, and nine Sell recommendations. The price target for TSLA stock is $176.96, implying 5.59% downside potential from current levels.

Questions or Comments about the article? Write to editor@tipranks.com