Tesla Inc. billionaire (TSLA) Elon Musk is now richer than investment guru Warren Buffett.

The fortune of Tesla’s founder rose $6.1 billion on Friday, according to the Bloomberg Billionaires Index, after the carmaker’s stock surged 11%. Musk is now the world’s seventh-richest person, also ahead of tech titans Larry Ellison and Sergey Brin.

Buffett’s fortune fell earlier this week when he donated $2.9 billion in Berkshire Hathaway stock to charity. The 89-year-old has given away more than $37 billion of Berkshire shares since 2006.

Musk owns about a fifth of Tesla’s outstanding stock, which makes up the lion’s share of his $70.5 billion fortune. His majority ownership of closely held Space-X accounts for about $15 billion.

Shares of the electric carmaker have jumped 269% this year. The firm’s ballooning valuation helped Musk land a $595 million pay-day earlier this year, making him the highest-paid CEO in the U.S.

Musk is the latest tech entrepreneur to rise above Buffett in the ranks of the world’s richest. Steve Ballmer, the former Microsoft Corp. (MSFT) CEO, and Google (GOOGL) co-founders Larry Page and Brin also have leapfrogged the Oracle of Omaha.

Tesla shares have this month already gained 43% as the carmaker reported second-quarter car deliveries, which exceeded analysts’ expectations. It delivered about 90,650 vehicles during the quarter. This compares with analysts’ estimates for about 74,130 vehicles.

Looking ahead, five-star analyst Daniel Ives at Wedbush says that although investors will be focusing next on 2Q earnings on July 22, he continues to believe that Battery Day now to be held on Sept. 22 will be a major positive catalyst for the stock.

“First on earnings around the corner, based on the 90k delivery number that Musk & Co. announced a few weeks ago it appears profitability is likely on the horizon and will be another major feat for Tesla in this very arduous COVID-19 backdrop,” Ives wrote in a note to investors. “While the Street reduced its annual delivery forecast to roughly 400k from its original 550k pre COVID, we now believe hitting 450k for the year could be in the cards.”

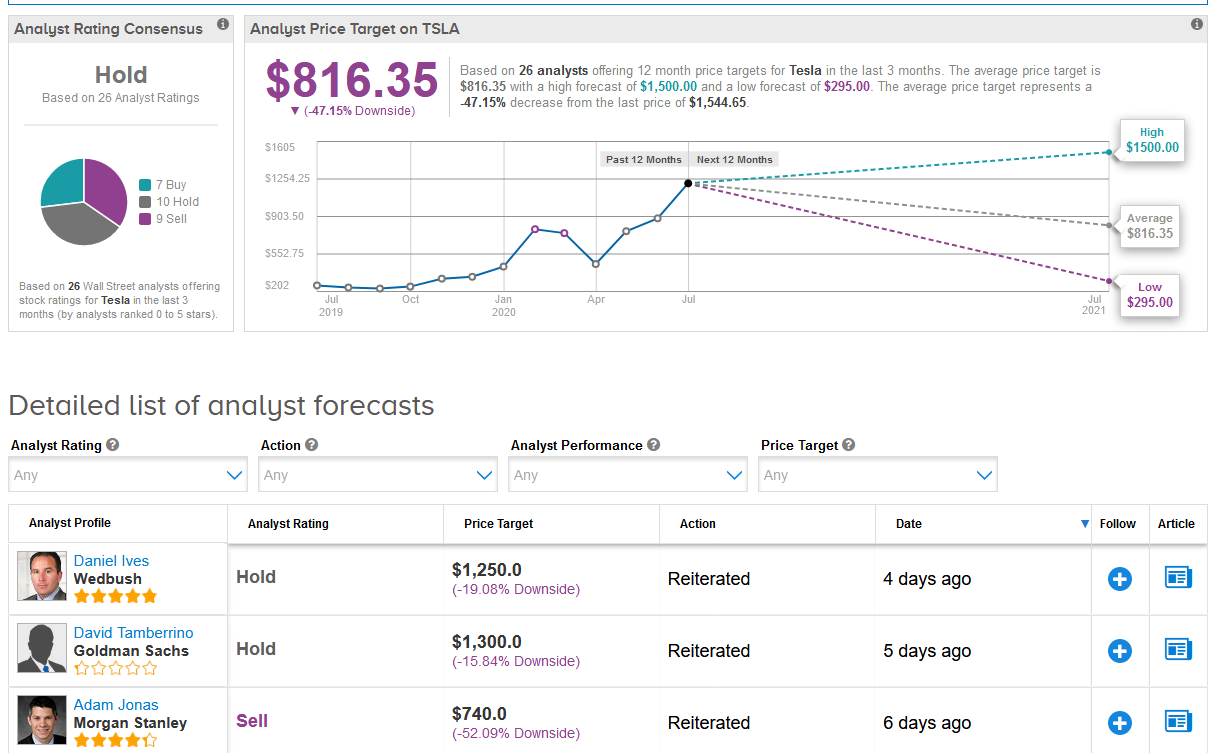

The analyst though maintained a Hold rating on the stock with a $1,250 price target for the base case and a $2,000 price target for the bull case. In line with Ives’s outlook, the majority of Wall Street analysts are sidelined on the stock with a Hold analyst consensus.

In light of the share’s rally this year, it is not surprising that the $816.35 average analyst price target now implies 47% downside potential to current levels. (See Tesla’s stock analysis on TipRanks).

Related News:

Tesla Slashes Model Y Crossover Price By $3,000

Tesla Up 8% As Quarterly Deliveries Surprise; Wedbush Says Stock Rally Isn’t Over

Nio Jumps 12% In Pre-Market On Record Quarterly Car Deliveries