Tesla (TSLA) is gearing up to release its third-quarter 2024 earnings on October 23. Wall Street analysts are forecasting earnings of $0.60 per share, marking a 9% decline from last year’s Q3. The expected drop in profits is likely due to shrinking margins, caused by Tesla’s price cuts in major markets as it deals with rising competition and broader challenges in the auto industry.

This makes Tesla’s margin performance a critical metric to watch in its Q3 report. It’s important to highlight that Tesla has already fallen by 13% in the last three months. If the company can report strong earnings and sustain healthier margins, it could boost the stock price.

However, there’s a silver lining: Q3 revenues are projected to grow by 9% year-over-year, reaching $25.46 billion, according to data from the TipRanks Forecast page given below.

Recent Events to Consider Ahead of Q3

Earlier this month, Tesla shared its third-quarter delivery numbers, reporting 462,890 vehicles. This marks a 6% increase from last year, but it was slightly below analysts’ expectations of 463,310. The shortfall highlights ongoing challenges from the economy and strong competition, particularly in China.

Another important event ahead of the Q3 report was the Robotaxi showcase on October 10, where Tesla introduced the Cybercab. Unfortunately, investors were left disappointed, as the event lacked the detailed information they had hoped for.

Nevertheless, Elon Musk’s emphasis on new technologies like robotics could be a wise long-term strategy as Tesla aims to expand beyond the competitive electric vehicle market.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can gauge options traders’ expectations for the stock post-earnings report. Based on a $207.5 strike price, with call options priced at $13.49 and put options at $0.01, the expected price movement, based on the at-the-money straddle is 7.39%.

Is Tesla a Buy, Sell, or Hold?

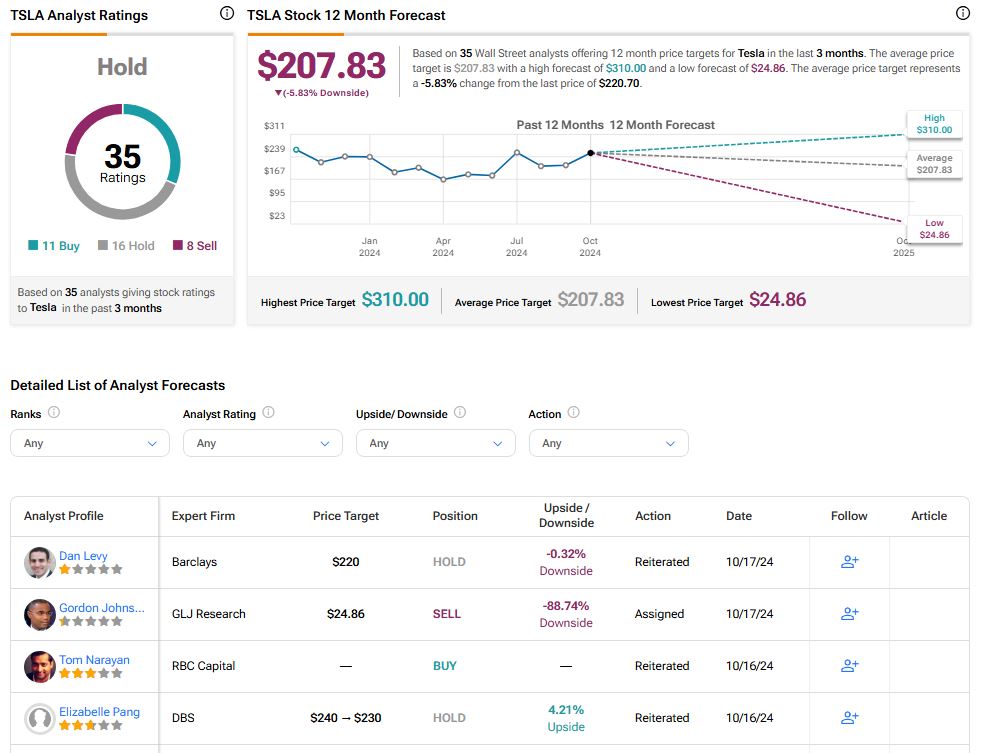

Turning to Wall Street, Tesla stock has a Hold consensus rating based on 11 Buys, 16 Holds, and eight Sells assigned in the last three months. At $207.83, the average TSLA price target implies 5.83% downside potential.