Tesla (TSLA) will release its Q2 2024 financial results on Tuesday, July 23. Analysts are expecting earnings per share to come in at $0.61 versus $0.91 per share reported in the prior-year period. Meanwhile, analysts expect revenues of $24.3 billion, reflecting a 2.3% year-over-year decrease, according to TipRanks’ data.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Tesla’s strong brand and leadership in EV technology indicate potential for continued growth. However, increased competition and a price war in the sector could impact Tesla’s Q2 profitability.

In terms of share price growth, Tesla’s stock has risen by 68% over the past three months. It will be interesting to see if the upcoming Q2 results will be able to sustain this rally in share price.

Insights from TipRanks’ Bulls & Bears tool

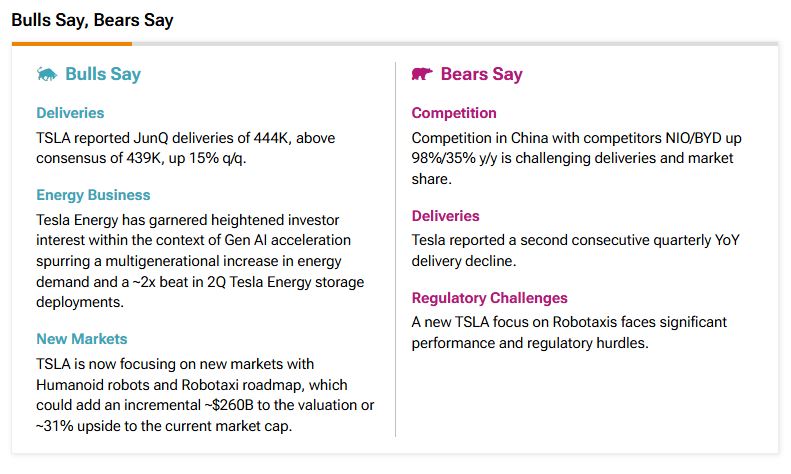

According to TipRanks’ Bulls Say, Bears Say tool, analysts point to an increase in energy demand and the company’s focus on new markets as reasons for this earnings growth. However, bearish analysts believe that competition in China and regulatory challenges could weigh on its results.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 9.41% move in either direction.

Is Tesla a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSLA stock based on 10 Buys, seven Holds and two Sells assigned in the past three months, as indicated by the graphic below. The average TSLA stock price target is $222.33, implying downside potential of 7.05%.