Tesla (NASDAQ:TSLA) CEO Elon Musk’s $46 billion pay package faces another hiccup. This time, proxy advisory firm Glass Lewis & Co. has advised Tesla’s shareholders to reject Musk’s compensation plan. Just last week, a group of TSLA’s shareholders, including Amalgamated Bank (AMAL) and SOC Investment Group, also asked investors to vote against Musk’s package.

Glass Lewis remains concerned about the excessive size of Musk’s compensation plan and the potential stock dilution impact on shareholders’ holdings. Furthermore, it noted that the package would boost Musk’s ownership stake in TSLA and solidify his position as the largest shareholder by a considerable margin. The firm also raised concerns about Musk handling several high-profile projects simultaneously.

Musk’s Compensation Journey

Musk’s compensation was initially approved by Tesla shareholders in 2018. However, the package was voided by a Delaware court in January due to concerns surrounding the approval process. The original package consisted of a 10-year grant of stock options with 12 vesting tranches based on the company reaching a market cap of at least $650 billion and hitting various revenue and profit targets.

Interestingly, Glass Lewis had raised similar concerns about the proposed pay package for Elon Musk in 2018.

Shareholders are scrutinizing Tesla’s proposed compensation package for Elon Musk due to its substantial size and concerns about the lack of TSLA’s board independence.

Is Tesla a Buy or Sell?

Tesla has a Hold consensus rating based on nine Buys, 14 Holds, and nine Sells. The analysts’ average price target on Tesla stock of $174.60 implies a downside potential of 2.6% from current levels. Year-to-date, the stock is down about 28%.

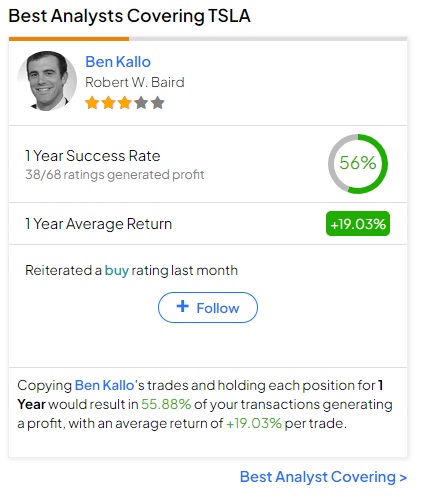

Interestingly, investors considering TSLA stock could follow Robert W. Baird analyst Ben Kallo. He is the best analyst covering the stock (in a one-year timeframe). He boasts an average return of 19.03% per rating and a 56% success rate. Click on the image below to learn more.

Questions or Comments about the article? Write to editor@tipranks.com