While Tesla (NASDAQ:TSLA) unquestionably maintains its position as the frontrunner in the electric vehicle (EV) industry, it is currently grappling with a multitude of challenges. In 2023, weakening demand led to a series of price reductions, effectively increasing sales volumes but adversely affecting profit margins.

Moreover, in the shape of Chinese EV maker BYD, the company has encountered a genuine contender (certainly in China) in the race for EV supremacy.

That said, despite these and other issues, Mizuho’s Vijay Rakesh, a 5-star analyst rated in the top 1% of the Street’s stock pros, thinks Tesla is set to keep its EV crown for a while.

“While there are multiple concerns with competitor ramps, particularly in China with BYD, China/US price cuts, and potential EV slowdown in the US, we continue to see BEV as the powertrain of the future and believe that over the long-term TSLA’s significant head start in EV manufacturing, vertically-integrated manufacturing process and technology leadership could help keep Tesla at the forefront of EV ramps as electrification is adopted globally,” Rakesh opined.

Furthermore, Rakesh counts Tesla’s improving battery tech, strong ADAS/AD roadmap, the potential of the Cybertruck (even though he concedes its opportunities will be “more muted near-term”) plus the possibility of a low-cost Model 2 coming to market in 2025E/26E, as other reasons why the company will keep its status as a leader in the global EV market.

It also helps that, aside from BYD in China, most competitors simply don’t have the scale and volume required to produce profitable EVs. Rakesh reckons Tesla will reach deliveries of ~2.3 million vehicles in 2024E, amounting to a ~25% year-over-year increase, while maintaining “good” OMs (operating margins, which currently stands at ~10%), even in the face of the recent price cuts.

There are risks involved, however, the biggest being a “significant slowdown of EV demand, forcing Tesla to further cut prices, impacting revenue and margin.”

Still, that is not enough to dampen Rakesh’s bullish outlook with the analyst giving TSLA shares a Buy rating and a $310 price target. Investors stand to pocket ~32% gain should the analyst’s thesis play out. (To watch Rakesh’s track record, click here)

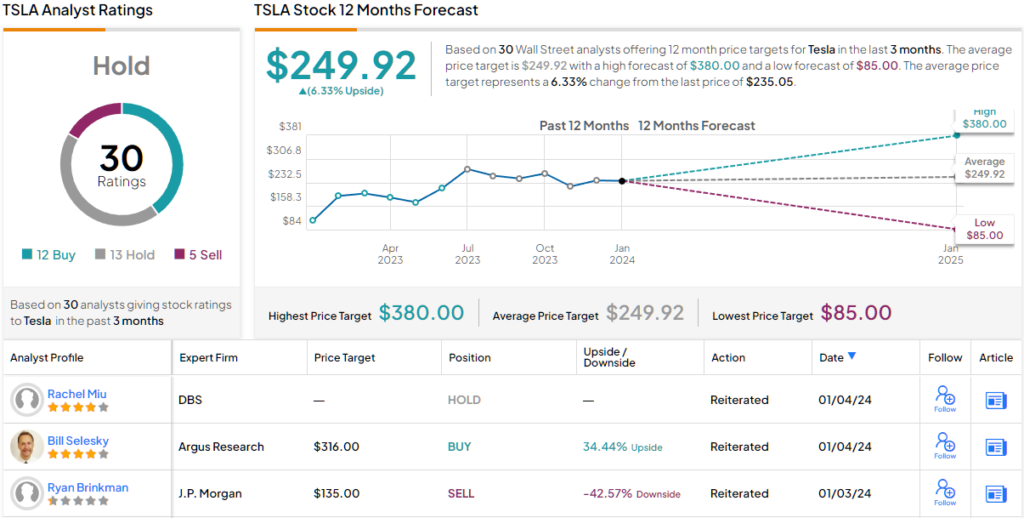

Tesla almost always elicits a wide variety of takes amongst Street analysts and that is also the case right now. Ultimately, the stock claims a Hold consensus rating based on a mix of 12 Buys, 13 Holds and 5 Sells. At $249.92, the average target suggests the shares have room for only modest growth of 6% in the year ahead. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.