Tesla (NASDAQ:TSLA) is currently faced with multiple challenges both in the near and long term and a dramatic one is about to get an airing rather sooner than later.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

At the June 13 annual general meeting, shareholders will decide whether to reinstate CEO Elon Musk’s pay package (currently valued at around $44.9 billion) after a Delaware judge voided the one approved in 2018 earlier this year.

According to Jefferies’ Philippe Houchois, a 5-star analyst ranked amongst the top 3% of Wall Street stock pros, regardless of whether the package receives a yes or no vote, neither outcome is likely to result in a definitive settlement.

“However ill-designed the scheme was, we believe denying Elon Musk his past compensation would look like misplaced ‘buyers remorse,’” says Houchois. “Conversely, veiled threats of taking AI business elsewhere look hollow given much investment Tesla has already made in AI.”

Houchois thinks Musk’s strength lies in tech innovation whilst also being driven by the need to dominate whatever markets he is interested in rather than being motivated by “competing to deliver sustained value creation.” As such, Houchois believes it is up to the Board to “find ways to reward Musk for technology milestones and introduce metrics for sustainable performance, both of which could argue for breaking up Tesla into more focused entities.”

Meanwhile, as far as the car biz is concerned, Houchois notes that for now, it is losing its edge. From “4680/dry-electrode to structural battery, mega-casting and charging,” the analyst believes the firm’s vertical integration and “innovation edge is shrinking.” In an industry that remains “driven by model proliferation,” the attempt at standardizing and scaling vehicles – while commendable – at the moment, “appears premature.”

On the subject of autonomous driving, with fuzzy business models regarding capital intensity and cost-per-mile benefits compared to current ride-sharing companies, apart from some recurring subscriptions, meaningful earnings from FSD or robotaxis seem to be several years away. “Securing approval of FSD in China looks encouraging,” Houchois notes a positive, while it could also act as a “reminder of how China has, in the past, leveraged Tesla to stir domestic competition.”

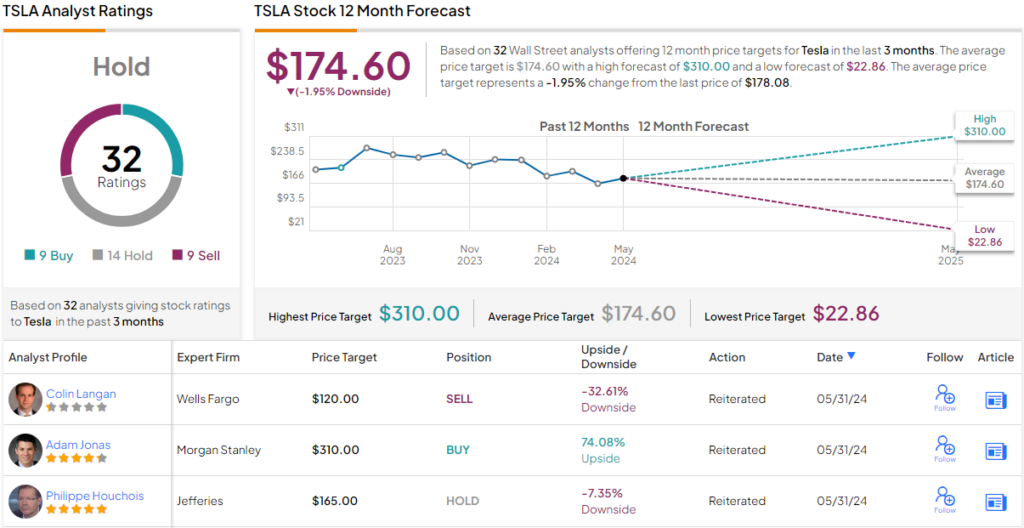

All told, Houchois rates Tesla shares a Hold (i.e., Neutral), along with a $165 price target, suggesting the stock is currently overvalued to the tune of 7%. (To watch Houchois’s track record, click here)

This sentiment is echoed by most of Houchois’s colleagues on Wall Street, with Tesla shares boasting a Hold consensus rating. The average price target currently stands at $174.60, implying the stock will remain rangebound for the time being. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.