Tesla (NASDAQ:TSLA) appears to be struggling in both China and the U.S. The company is expected to report “sluggish” deliveries for the first quarter next week. Adding to this, the EV major is facing rising competition in China from domestic players such as Xiaomi (OTC:XIACF) and BYD (OTC:BYDDY).

Overall, analysts expect the automaker to deliver 458,500 vehicles in the first quarter, according to a Reuters report. If Tesla manages to hit this number, it would be an increase of 8.4% year-over-year but it would be a decline of 5% from the previous quarter.

Rising Competition in China’s EV Market

In China, demand for EVs is slowing down and domestic players are introducing newer, cheaper models as compared to Tesla’s cars. Chinese smartphone maker Xiaomi launched a sporty electric car, SU7 EV that will be priced lower than Tesla’s Model 3. The company’s management stated that the standard version of the SU7 will be priced at $29,872 or RMB215,900. Tesla’s Model 3 starts at RMB245,900 in China.

Meanwhile, BYD, another Chinese player that trumped Tesla as the world’s biggest EV seller late last year, is targeting sales of 3.6 million vehicles this year, an increase of 20% year-over-year. The company is targeting sales of 500,000 vehicles in overseas markets this year and is looking at selling 1 million units in 2025.

In contrast, NIO (NYSE:NIO) trimmed its delivery outlook for the first quarter and now expects to deliver around 30,000 vehicles in Q1 2024, down from its previous forecast in the range of 31,000 to 33,000 units. This lowered outlook comes amidst flagging demand and fierce competition in China’s EV market.

Factors Impacting Tesla’s Vehicle Deliveries

Tesla’s vehicle deliveries have been impacted by several factors in recent times. Although the company has been actively reducing the prices of its electric vehicles since 2022, it has been slow in updating its aging model lineup. This delay, combined with production challenges at its facilities in Fremont, California, and a recent shutdown at the Gigafactory in Berlin, has posed significant hurdles.

Furthermore, while Tesla has introduced changes to its Model 3, the ramp-up in production has faced obstacles, leading to delays. Additionally, Tesla’s Model 3 compact sedans do not qualify for the $7,500 federal tax credit under the Inflation Reduction Act (IRA), which could influence consumer choices.

Another contributing factor to the slower pace of vehicle deliveries is the shift in consumer preferences in the U.S. towards more affordable hybrid vehicles. Hybrid vehicles are preferred for their fuel efficiency, offering a practical choice with longer driving ranges compared to solely battery-powered electric vehicles.

Morgan Stanley Analyst’s Concerns on Tesla’s Pricing

Even Morgan Stanley’s top-rated analyst, Adam Jonas, suggests that Tesla might be experiencing “price-cut fatigue,” a term indicating a possible exhaustion in the effectiveness of continuous price reductions at the cost of the company’s profitability. This issue is exacerbated by an outdated product lineup, leading to uncertainties about profitability in the short term with limited prospects for improvement.

In addition to this, the analyst has reduced his Q1 delivery estimate to 425,400 units from 469,400 and FY24 projection to 1.95 million units from 1.99 million.

However, Jonas maintains a Buy rating and a price target of $320 on TSLA, implying an upside potential of 82% at current levels.

Overall, Wall Street’s pessimistic outlook has resulted in TSLA stock declining by more than 25% year-to-date.

What is the Price Prediction for Tesla Stock?

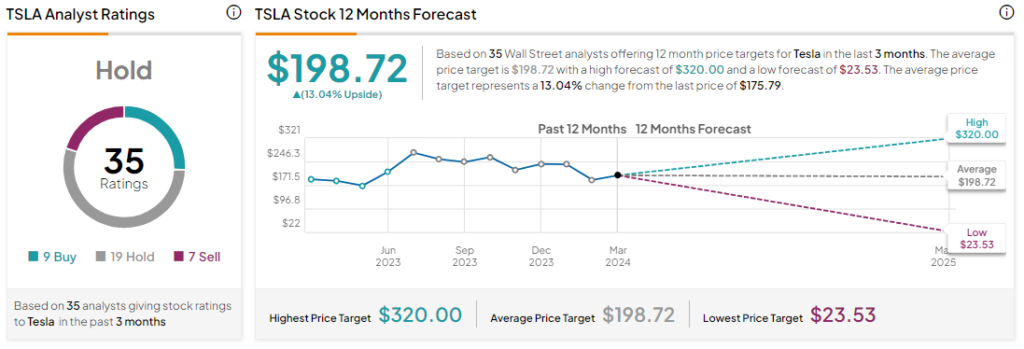

Analysts remain sidelined about TSLA stock with a Hold consensus rating based on nine Buys, 19 Holds, and seven Sells. The average TSLA price target of $198.72 implies an upside potential of 13% at current levels.