Since Donald Trump achieved victory over Vice President Kamala Harris last week, short sellers have suffered a significant loss. Due to Elon Musk’s relationship with Trump, TSLA stock (TSLA) has been benefiting significantly from Trump’s win, rising steadily all week. According to calculations from Bloomberg, Tesla short sellers have lost at least $5.2 billion so far, and TSLA stock is still trending upward.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Shares of Trump Media & Technology Group (DJT), the parent company of Truth Social, have been volatile since the election, but Tesla’s growth trajectory has been steady. This suggests that Tesla may end up being the strongest Trump trade as the U.S. prepares for a political shift.

What’s Happening with Tesla Stock Today?

Despite some volatility this morning, Tesla stock is performing well overall. As of this writing, it is up 8% for the day, and its current trajectory suggests that this growth could easily continue. Since Trump’s victory, TSLA has been making steady progress as the possibility of Musk working with the future president inspires investor confidence, with gains of 20% over the past five days.”

Given the election momentum that Tesla is still riding, it is likely that shares will continue trending upward as Trump prepares to take office. That’s bad news for any short sellers who haven’t closed out their bets against Tesla yet. Bloomberg notes that when Musk endorsed Trump for president on July 13, 2024, many investors adjusted their TSLA stock positions accordingly.

These steep losses have likely compelled short sellers to wind down their Tesla bets. Data from Fintel shows that short interest currently accounts for less than 3% of Tesla stock’s float. Additionally, the number of TSLA shares available to short has significantly increased, showing a clear lack of interest from bearish investors.

Wall Street Is Sidelined on Tesla Stock

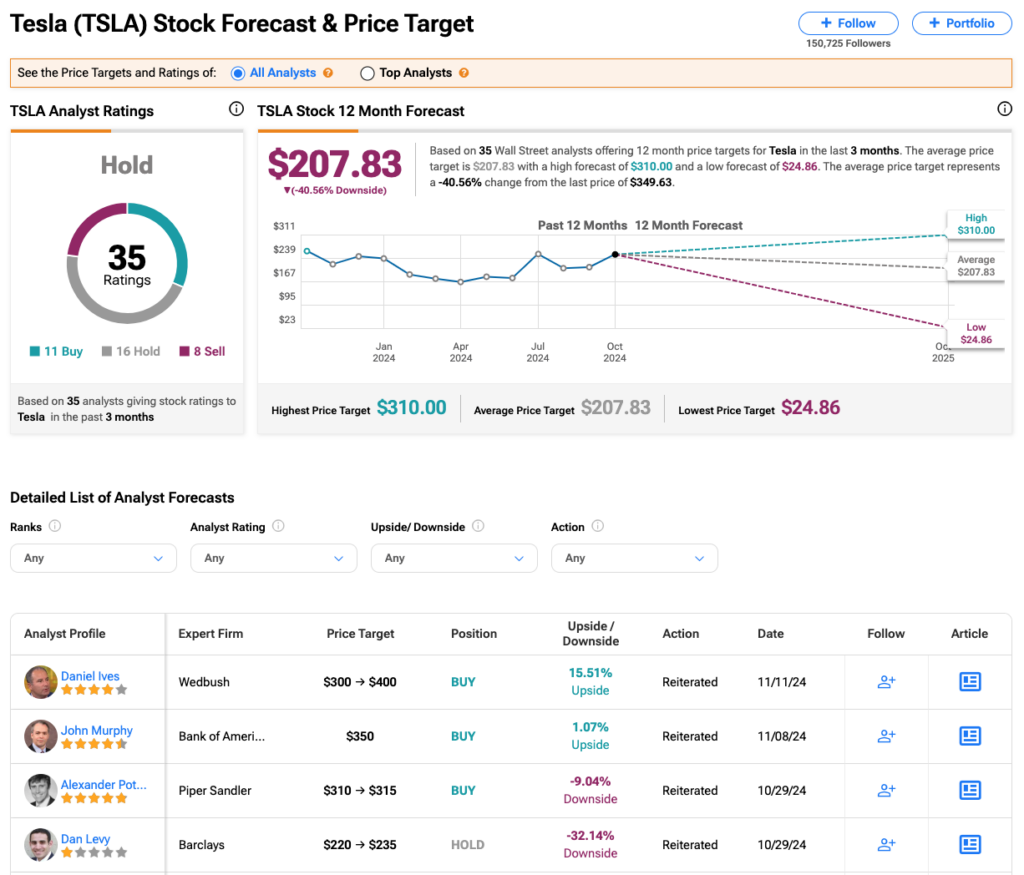

Despite Tesla’s recent growth, Wall Street is still sidelined on it. Analysts have a Hold consensus rating on TSLA stock based on 11 Buys, 16 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. After a 55% rally in its share price over the past year, the average TSLA price target of $207.83 per share implies 41% downside potential.