Tesla (NASDAQ:TSLA) workers are likely cheering this morning as word of a planned pay raise for production workers in the United States emerged. But investors are a lot less cheerful about the proposition, and they sent shares of the electric vehicle stock down over 3% in Thursday morning’s trading.

The word emerged earlier today that quality inspectors, production associates, and material handlers would be getting a “market adjustment pay increase.” How much money that translates to was unclear, as Tesla wasn’t talking about that point. The move is largely seen as a means to insulate Tesla from unionization, which seriously impacted United States vehicle production a few months ago in 2023.

Indeed, Tesla has come out against unions before, noting that if Tesla were to become a union shop, it would be regarded as the firm failing in some way. Tesla also pointed out that it’s made several of its employees millionaires via stock options and the like.

Right Move, Wrong Time?

There’s something to be said for fending off a union. If the workers aren’t interested in unionizing, then there’s a lot less risk of slowdowns, shutdowns, and the kind of thing that slammed autoworkers just a few months ago. That should be good news, even as Tesla has been suffering from declining margins in the face of a market that seems a lot less interested in electric vehicles than it was a year or two ago. Worse, Tesla just took another bit of bad news, as Hertz (NASDAQ:HTZ) plans to sell a third of its entire electric vehicle fleet and replace them with internal combustion vehicles.

What is a Fair Price for Tesla Stock?

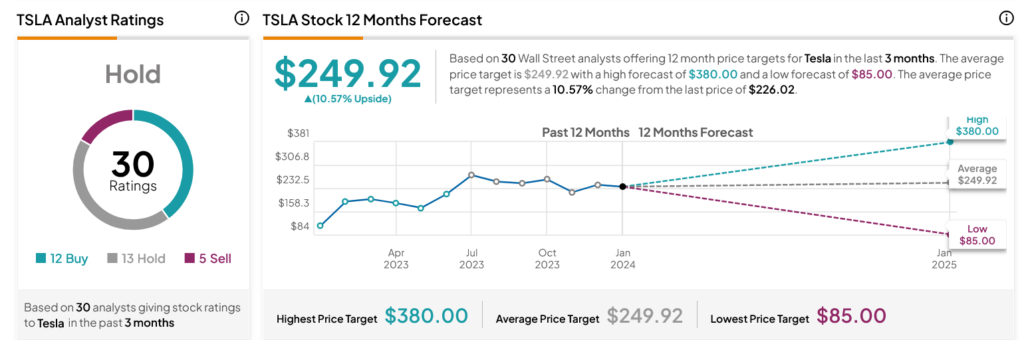

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 12 Buys, 13 Holds, and five Sells assigned in the past three months, as indicated by the graphic below. After an 83.13% rally in its share price over the past year, the average TSLA price target of $249.92 per share implies 10.57% upside potential.