For those who are called upon to name an electric vehicle stock, Tesla (NASDAQ:TSLA) is probably the first on the list. However, there’s a growing chance that it may soon be only one of the first, as it recently lost its acclaim as the most popular electric vehicle maker out there to a Chinese electric vehicle maker, BYD (HK:1211) (OTC:BYDDF). This didn’t faze Tesla investors, however, who pushed Tesla up over 2% in Wednesday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BYD has been billing itself for some time now as “the biggest car brand you’ve never heard of.” But for a growing number of buyers out there, that’s less the case than ever, as more and more buyers know the name. In fact, Tesla’s Elon Musk once disputed the notion he would ever find himself competing with BYD, noted one report. Now, he faces the exact condition he never thought would happen. BYD’s success, according to Snow Bull Capital head of China operations Bridget McCarthy, stems from the speed of its innovation, a field long thought dominated by Musk himself.

A Study of Differences

One key point of separation between Tesla and BYD, for example, stems from the market itself. Musk has asserted that consumers who can afford his vehicles in the current market are on the decline. But BYD, meanwhile, has aggressively pursued lower-cost options to the point where it offers half a dozen different electric vehicles priced less than the Model 3, at least in China. In fact, Musk recently ate his own words, noting in an interview that BYD’s vehicles are “…highly competitive these days.”

Yet, don’t count out Tesla yet; while most of Tesla’s revenue comes from electric vehicles—84% at last report—that could change in a little over three years. The new potential winner at Tesla? Self-driving vehicle technology, which could take over the lion’s share of Tesla’s revenue by 2027.

What is the Fair Price of Tesla Stock?

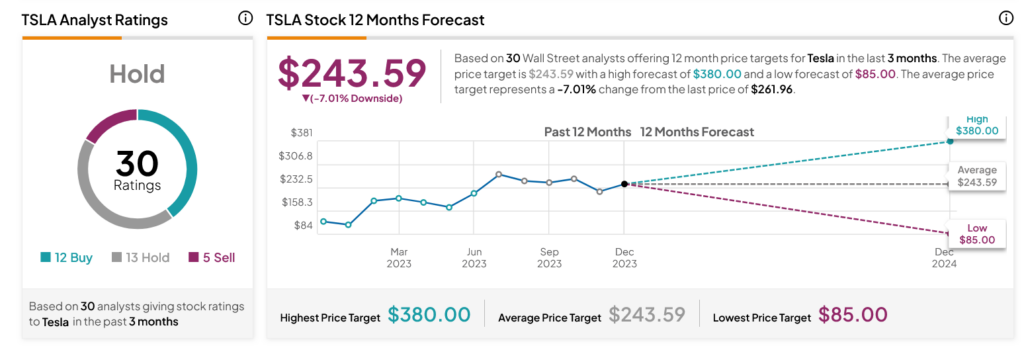

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 12 Buys, 13 Holds, and five Sells assigned in the past three months, as indicated by the graphic below. After a 132.51% rally in its share price over the past year, the average TSLA price target of $243.59 per share implies 7.01% downside risk.