The U.S. automobile safety regulator, the National Highway Traffic Safety Administration (NHTSA), has opened an investigation into whether Tesla’s (NASDAQ:TSLA) recall of over 2 million vehicles for new Autopilot safeguards is sufficient. In December of last year, the EV major rolled out an over-the-air update for 2.03 million vehicles to address Autopilot control concerns raised by the NHTSA.

Reason for Probe on Tesla

The NHTSA stated that it was opening this investigation as it remained concerned about crash events, and the results of its tests on TSLA vehicles that received the Autopilot update installed indicated the same. The NHTSA scrutiny will cover Model Y, X, S, 3, and Cybertruck vehicles in the U.S. equipped with Autopilot produced between 2012 and 2024.

The opening of this probe comes just after the NHTSA closed a three-year investigation into Tesla’s Autopilot that highlighted concerns about Tesla’s Autopilot’s “permissive operating capabilities,” resulting in a “critical safety gap.” The NHTSA’s probe highlighted potential crash risks when drivers don’t maintain control or fail to recognize system changes.

Furthermore, the NHTSA commented that the company had issued software updates addressing related concerns but hadn’t included them in the recall or attempted to remedy a defect that posed an “unreasonable safety risk.”

Is Tesla a Buy, Sell, or Hold?

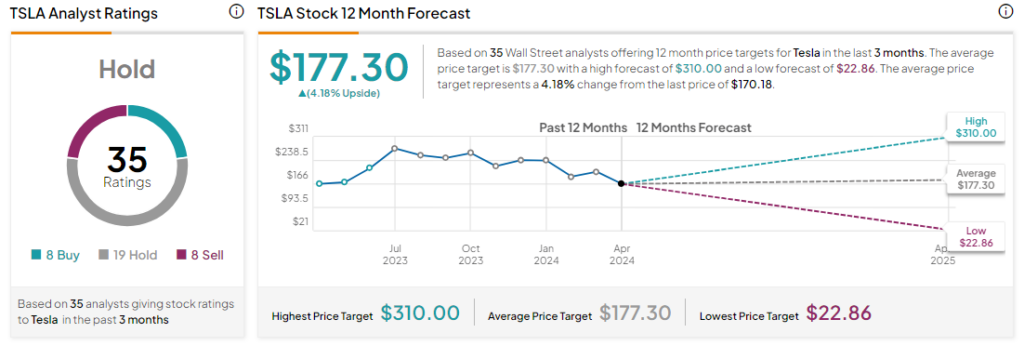

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on eight Buys, 19 Holds, and eight Sells. Year-to-date, TSLA has declined by more than 30%, and the average TSLA price target of $177.30 implies an upside potential of 4.2% from current levels.