After witnessing higher demand for its vehicles in China and the U.S., Tesla (NASDAQ:TSLA) is now expanding its discount strategy to Europe, Israel, and Singapore. Meanwhile, the latest move continues to raise concerns about its profit margin.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company has reduced prices in the European market, including Germany and France, for the Model 3 and Model Y by 4.5% to 9.8%.

Furthermore, in Israel, Tesla cut the price of its base Model 3 by 25%. In Singapore, the company has provided discounts ranging from 4.3% to 5% for Model 3 and Model Y.

It is worth mentioning that Tesla reduced prices for its Model S sedan, Model X sport utility vehicle, Model 3 sedan, and Model Y crossover vehicles in the United States last week. In fact, so far in 2023, the company has cut the price of its base Model 3 and Model Y in the U.S. by about 11% and 20%, respectively.

Tesla will release its Q1 earnings report on April 19.

Is Tesla Stock a Buy, Sell, or Hold?

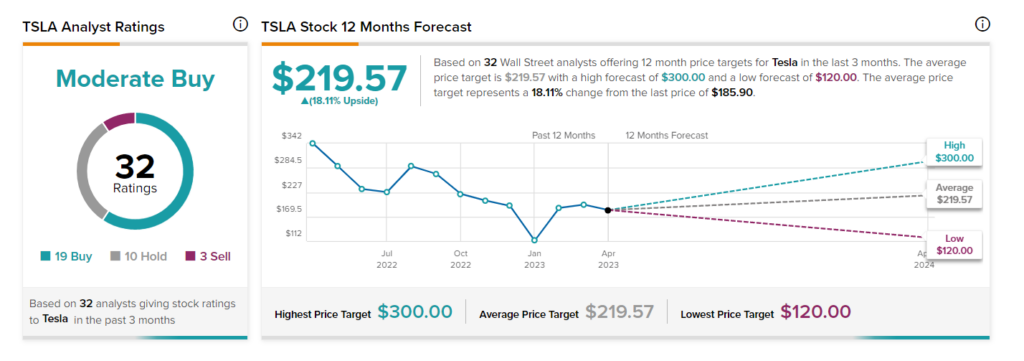

Wall Street is cautiously optimistic about Tesla, with a Moderate Buy consensus rating based on 19 Buys, 10 Holds, and three Sells. The average price target of $219.57 suggests upside of 18.1%.