EV giant Tesla Inc. (NASDAQ:TSLA) has launched a new base version of its Model Y vehicle in Europe, which will be made available from December.

The rear-wheel-drive (RWD) model has a range of 455 km (283 miles), a top speed of 217 km/h, and goes from zero to 100 km in 6.9 seconds. While the top speed is the same as the already available Long-Range model, the range is lower compared to 533 km (331 miles).

The entry-level version of Tesla’s Model Y has a starting price of €50,000, which is €16,000 lesser than the long-range version.

The launch comes as a surprise following CEO Elon Musk’s remark last month that “Tesla won’t produce the cheaper version of the Model Y because the range would be unacceptably low at less than 250 miles (402 km).”

Is Tesla Stock a Buy, Sell or Hold?

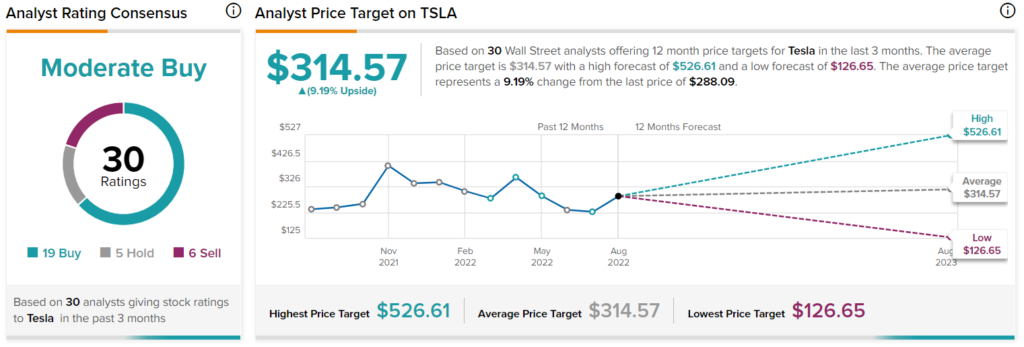

On TipRanks, Tesla has a Moderate Buy consensus rating based on 19 Buys, five Holds, and six Sells. TSLA’s average stock forecast of $314.57 implies a 9.2% upside.

Emmanuel Rosner of Deutsche Bank (NYSE:DB) is one of the Wall Street analysts who has a Buy rating on the stock. On August 29, the analyst lowered Tesla’s price target to $375 from $1,125 (30.2% upside potential).

Rosner recently did a guided tour of the company’s new Gigafactory in Berlin. He believes that local vehicle production in Europe “could be a game-changer” for Tesla and could make it an “even more formidable competitor in the region,” along with boosting its gross margins.

In a research note to investors, Rosner said, “2023 could be a pivotal year for Tesla” and considers the EV maker “as one of the most attractive stories in the auto sector.”

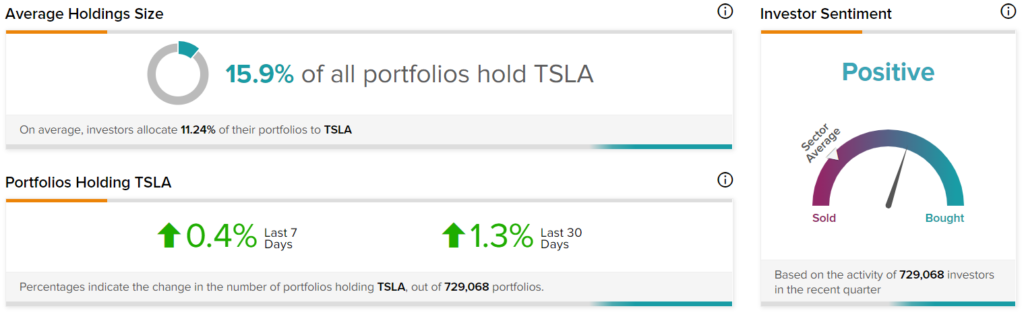

Meanwhile, bloggers and retail investors are also cautiously optimistic about TSLA. TipRanks data shows that financial bloggers are 67% Bullish on the stock, compared to the sector average of 64%. Further, 1.3% of retail investors increased their exposure to TSLA stock over the past 30 days.

Read full Disclosure