Tesla Inc. (TSLA) is reportedly pushing for a new all-time record in deliveries in the third quarter despite the coronanvirus pandemic impact on the economy and a renewed wave of infectious cases.

The electric carmaker has informed its staff that the goal for this quarter is a new all-time record in deliveries, according to Electrek. Tesla’s last all-time delivery record was in Q4 2019 when it delivered 112,000 vehicles.

During the second quarter, Tesla’s production was affected by the pandemic, like most other automakers. Its main California factory was shut down for more than a month, and a lot of its retail operations were closed due to restrictions put in place to try to slow down the pace of the pandemic.

What’s more, the global economic crisis made many people think twice about a large purchase like a vehicle. Nonetheless, Tesla performed relatively well, with deliveries being down only 5% compared to last year while most other automakers saw a decline of 30% or more in deliveries.

Production at Gigafactory Shanghai has ramped up significantly since Q4 2019, which is going to help Tesla achieve its goal on the production side along with Model Y production resuming at its California factory, which should be operating for most of the quarter.

Furthermore, Tesla has taken a number of steps that should boost demand this quarter to match higher production capacity. Back in May, Tesla cut the price of the Model 3, which is still the automaker’s best-selling vehicle, and it now sells for $38,000 in the U.S.

In addition, Tesla recently lowered the price of the base Model Y, and last weekend, the automaker introduced a lease option on the new electric SUV.

The electric carmaker’s shares have surged 293% year-to-date as it reported 90,650 car deliveries in the second quarter, which exceeded analysts’ expectations for about 74,130 vehicles.

The stock is advancing 2.5% at $1,683.98 in Tuesday’s pre-market trading after yesterday jumping almost 10% as investors await the release of the company’s quarterly earnings on Wednesday.

Ahead of the financial results, five-star analyst Daniel Ives at Wedbush said yesterday that “anticipation is high as profitability this quarter will result in S&P 500 inclusion and is already considered a fait accompli among the bulls”.

“In a nutshell the success in China out of the gates is a major achievement for Tesla and if this trajectory continues will be a “game changer” for its EV penetration story over the next decade and a highlight during earnings this week,” Ives wrote in a note to investors. “This quarter is another step forward in the Tesla story as Musk & Co. must deliver to match euphoric Street expectations baked into the stock.”

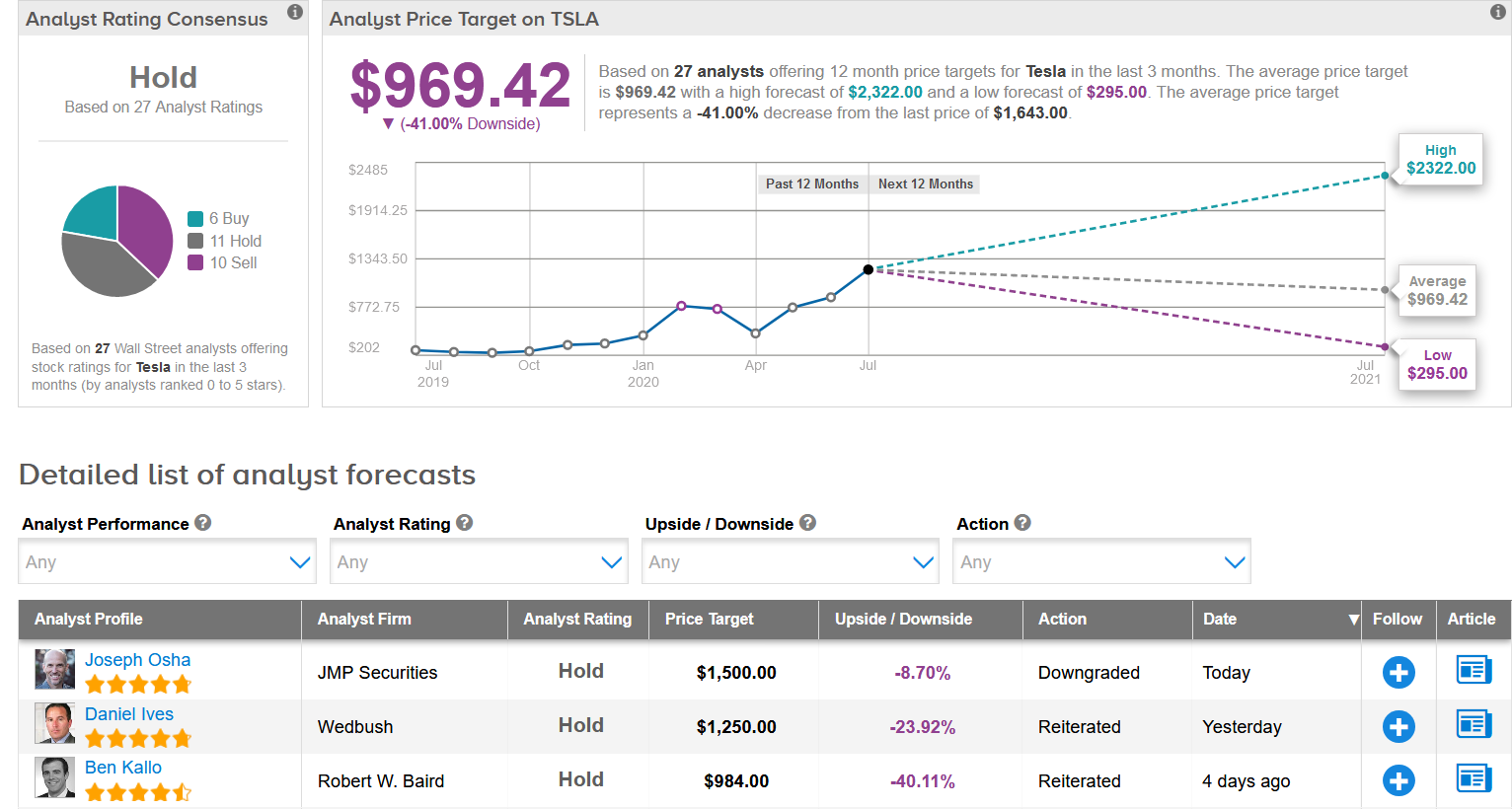

For now, the analyst though maintains a Hold rating on the stock with a $1,250 price target for the base case and a $2,000 price target for the bull case.

In light of this year’s strong rally, the $969.42 average analyst price target now implies 41% downside potential for the shares in the coming 12 months. (See Tesla’s stock analysis on TipRanks).

Related News:

The Fate of Nikola (NKLA) Stock Remains Up in the Air

Tesla’s Elon Musk Overtakes Buffett On Billionaires Rich List

GM To Release Electric Truck Next Year With 20 More EVs By 2023