Tesla, Inc. (NASDAQ: TSLA) has inked a deal with Talon Nickel LLC, the U.S. subsidiary of Talon Metals Corp. (TSX: TLO), for the purchase of nickel concentrate to be produced from the Tamarack Nickel Project in Aitkin County, Minnesota. The EV maker plans to make the electric vehicle battery metal in a more environmentally-friendly manner.

Talon is a base metals company in a joint venture with Rio Tinto on the high-grade Tamarack Nickel Project. Talon currently owns a 51% interest in the Tamarack Project and has the right to increase its stake by 9% to 60%.

Benefits of the Deal

Demand for nickel is expected to jump over the next decade on the growing momentum in the EV market. Notably, Nickel boosts energy storage in a battery’s cathode, which in turn, extends the range of EVs.

Therefore, the deal with Talon secures Tesla’s key U.S. source of the metal for its battery factories in Texas and Nevada. Last year, Tesla signed nickel supply deals with BHP in Australia and from New Caledonia.

Terms of the Agreement

Per the terms of the agreement, Tesla will purchase 75,000 metric tonnes (165 million pounds) of nickel in concentrate over a period of six years. Additionally, the company has a preferential right to purchase additional nickel concentrate over and above the committed 75,000 metric tonnes if needed.

The agreement is conditional on Talon earning a 60% interest in the Tamarack Nickel Project, the commencement of commercial production at the Tamarack Nickel Project by Talon, and the execution of detailed supply terms and conditions.

Talon is expected to commence commercial production on or before January 1, 2026, at the Tamarack Nickel Project, which might be extended for up to 12 months, following which Tesla has the right to terminate the agreement and Talon can sell to other parties.

Notably, the price at which Tesla will purchase the nickel concentrate will be linked to the London Metals Exchange (LME) official nickel cash settlement price. Also, any additional economics gained from by-products of the nickel concentrate, such as iron and cobalt, will be shared by both parties.

Official Comments

SVP of Powertrain and Energy Engineering at Tesla, Drew Baglino, said, “The Talon team has taken an innovative approach to the discovery, development and production of battery materials, including to permanently store carbon as part of mine operations and the investigation of the novel extraction of battery materials. Responsible sourcing of battery materials has long been a focus for Tesla, and this project has the promise to accelerate the production of sustainable energy products in North America.”

Analyst Recommendations

Yesterday, Goldman Sachs analyst Mark Delaney maintained a Buy rating on Tesla and lifted the price target to $1,200 (13.41% upside potential) from $1,125.

Delaney increased his estimates to reflect “robust” deliveries in the fourth quarter, and he expects the company to sell more vehicles in 2022 and 2023.

Furthermore, the analyst anticipates Tesla to expand margins in the intermediate term driven by its Model Y product and new factories in Berlin, Germany, and Austin, Texas.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 15 Buys, 9 Holds, and 5 Sells. The average Tesla stock forecast of $1,053.73 implies that shares are fully valued at current levels. Shares have gained 24.6% over the past year.

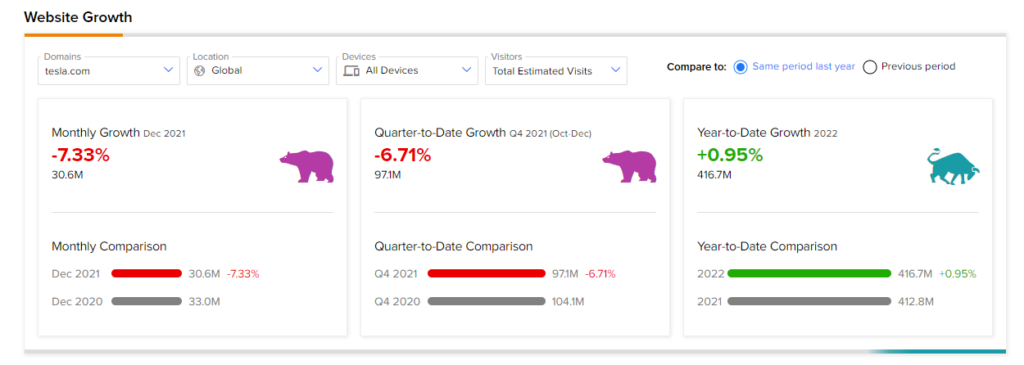

Website Traffic

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Tesla’s performance.

According to the tool, the Tesla website recorded a 7.33% decrease in global visits in December compared to the same period last year. Also, a quarter-to-date comparison showed a decline of 6.71% compared to Q4 2020, while year-to-date website traffic growth stands at 0.95%.

Download the TipRanks mobile app now

Read full Disclaimer & Disclosure

Related News:

Ocugen Reveals Positive Results from Phase 2 Analysis of COVAXIN

FedEx Operations Affected by Omicron & Bad Weather – Report

Bank of America to Reward Employees with Higher Bonuses – Report

Questions or Comments about the article? Write to editor@tipranks.com