After reporting blockbuster third-quarter vehicle deliveries, electric vehicle (EV) manufacturer Tesla, Inc. (TSLA) has announced an increase in the prices of its popular EV Model 3 and Model Y variants. Shares closed at $782.75 on October 6.

Tesla raised the prices of its model series S3XY several times during the first half of 2021 and left them unchanged during the third quarter. The company’s latest price increase is effective from the fourth quarter and is targeted at two of its most sold vehicles, the Model 3 and Model Y. Its Model S and X variants remain unaffected by the recent round of price changes.

Despite the volatility in prices, customers continue to show their loyalty towards Tesla’s electric vehicles. Deliveries have reflected strong momentum quarter-over-quarter, and the company predicts that the recent price hikes will not affect future demand. (See Tesla stock charts on TipRanks)

With the price increase, the Tesla Model 3 Standard Range Plus will now cost $41,990, a hike of $2,000, and has an estimated delivery date of April 2022. The Model 3 Performance will also cost $1,000 more than before, with estimated delivery in November 2021.

As for the Model Y, the Long Range series will now cost $54,990 and has an estimated delivery date of April 2022. Additionally, the Model Y Performance Range also saw a $1,000 price increase, with estimated delivery in December 2021.

Yesterday, Wedbush analyst Daniel Ives maintained a Buy rating on the stock with a price target of $1,000, implying 27.8% upside potential to current levels.

Ives noted that Tesla is set to hold its annual shareholder meeting at its Gigafactory in Austin on October 7, during which the focus will be on the global chip shortage and Tesla’s efforts to produce its own chips. Tesla remains a favorite EV stock for the analyst with a $5 trillion EV market over the next decade.

Ives commented, “While we do not expect any major announcements at the event, we believe Tesla will give an update on the openings of the key Austin and Berlin factories which remain linchpins to expanding production globally. Austin in particular is very important as it will be the Cybertruck factory and down the road, we ultimately believe Austin will be more of a domestic hub than Fremont given its size, location, and strategic blueprint.”

Ives added, “Despite the red tape, we believe Berlin is set to start producing cars over the next month which should relieve a major logistics bottleneck as today most Model 3’s/Y’s are being produced in China and shipped to Europe.”

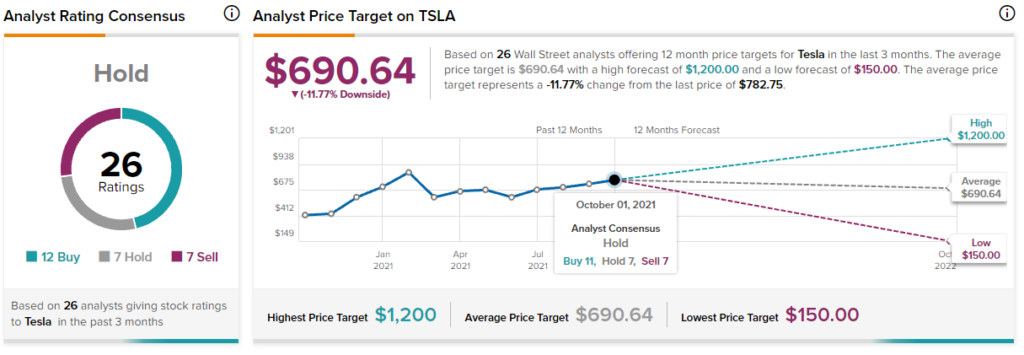

Overall, the stock has a Hold consensus rating based on 12 Buys, 7 Holds, and 7 Sells. The average Tesla price target of $690.64 implies 11.8% downside potential to current levels. Shares have gained 84.1% over the past year.

Related News:

Scientific Games to Buy ACS PlayOn, Enhance Cashless Solutions

J & J Applies for Emergency Use Authorization for COVID-19 Booster

Xerox Snaps Up Competitive Computing; Shares Rise