Tesla (TSLA) fell 4.5% to $1,568.36 on Tuesday after JMP Securities analyst Joseph Osha downgraded it to Hold from Buy. Moreover, Osha removed his price target, which he had previously raised to $1,500 on July 6.

The analyst downgraded Tesla ahead of 2Q earnings and said that “the company’s valuation now slightly exceeds the $1,500 price target that we established recently, and we believe that any intermediate-term success that Tesla might discuss during its earnings call tomorrow is now fairly reflected in the stock price.”

The analyst remains bullish on the long-term prospects of the company and believes that Tesla is well-positioned to become a $100 billion car company by 2025. However, given the significant growth in its stock and challenges related to earning additional returns, its valuation seems unjustified.

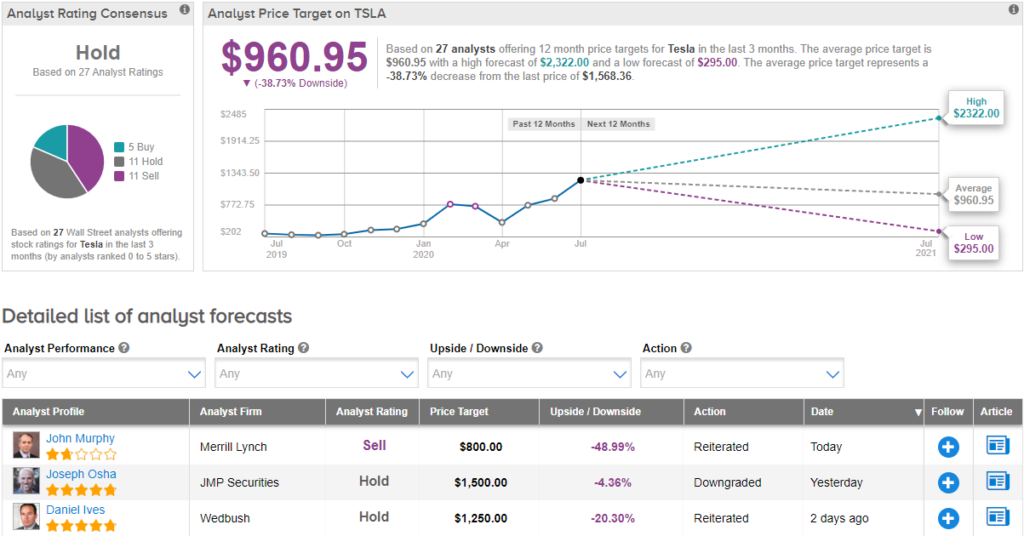

Overall, the majority of analysts are sidelined on the stock with a Hold analyst consensus. Tesla has rallied nearly 275% this year and is up over 513% in one year. Given the steep rise in its stock, the average analyst price target of $960.95 implies a 38% downside potential. (See Tesla’s stock analysis on TipRanks).

Related News:

Tesla’s Elon Musk Qualifies For $2B+ Payout Backed By Share Rally

Tesla Is Said To Push For Record Q3 Deliveries; Shares Rise In Pre-Market

Peak Earnings Season Kicks Off This Week, Here’s What to Watch