TerrAscend Corp. (TER), an integrated cannabis company operating in Pennsylvania, New Jersey, and California, reported a wider loss in the second quarter of Fiscal Year 2021 — despite a rise in sales — and withdrew guidance for full-year 2021. Shares were down 16% in early trading Thursday.

Net sales came in at $58.7 million for the quarter ended June 30, an increase of 72% year-over-year. This strong growth was driven by acquisitions, more dispensaries, and the expansion of cultivation capacity in Pennsylvania, New Jersey, and California.

Adjusted gross profit margin was 61% in Q2 2021, compared to 56% in Q2 2021. (See TerrAscend Corp stock charts on TipRanks)

Adjusted EBITDA almost tripled year-over-year to $24.3 million. The adjusted EBITDA margin was 41%, higher than 25% in Q2 2020. Net loss amounted to $23.1 million, 135.4% worse than the loss of $9.8 million reported a year ago.

Cash flow from operations was $3.4 million in the second quarter of 2021, compared to $7.2 million in the prior-year quarter.

The cannabis operator had a cash balance of $154 million at the end of the quarter, which will be used to support future growth initiatives.

TerrAscend’s executive chairman Jason Wild said, “Due to expansion related yield reduction in Pennsylvania, which I believe to be temporary, and a decision to prioritize allocation of our branded products to our own New Jersey dispensaries, I felt it was appropriate to withdraw guidance for 2021.

“Looking ahead, 2022 will be a breakout year as we benefit from investment in cultivation capacity expansions and best-in-class retail experiences.”

In addition, TerrAscend announced that it has signed an agreement with COOKIES, one of the most recognized and lucrative lifestyle brands in the U.S., to bring its products to New Jersey.

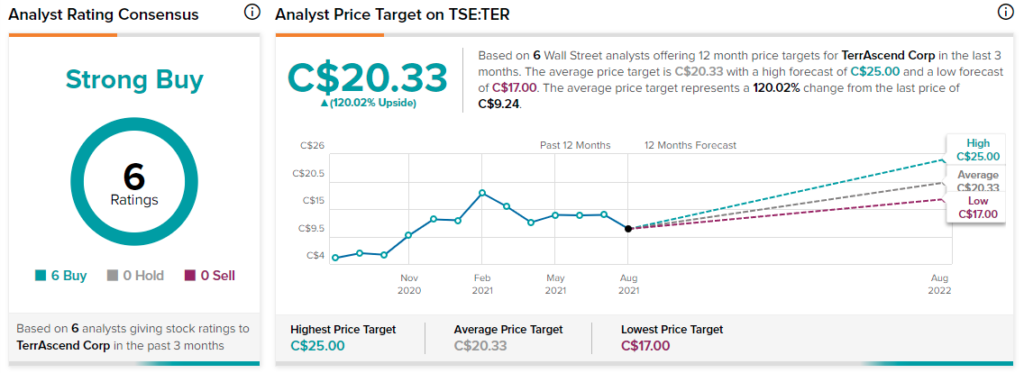

Last week, Clarus analyst Noel Atkinson maintained a Buy rating on TER and a C$20.00 price target. This implies 116.5% upside potential.

Overall, consensus on the Street is that TER is a Strong Buy based on six Buys. The average TerrAscend Corp price target of C$20.33 implies 120% upside potential to current levels.

Related News:

Village Farms Buys CBD Leader Balanced Health Botanicals

Trulieve Profit More Than Doubles in Q2

Cronos Group Posts Larger Gross Loss in Q2