TerrAscend Corp (TER), an integrated cannabis company operating in Pennsylvania, New Jersey, and California, announced strong Q1 net sales and raised guidance for full-year 2021.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Net sales came in at $53.4 million for the quarter ended March 31, an increase of 106% quarter-over-quarter, primarily driven by five new dispensary openings in 2020 and expanding cultivation capabilities in Pennsylvania, New Jersey, and California.

Adjusted gross profit margin was 65% in Q1 2021, a significant improvement compared to the gross margin of 45% in Q1 2021.

Meanwhile, Adjusted EBITDA more than quintupled to $22.6 million. The Adjusted EBITDA margin was 42%, higher than the 14% achieved in Q1 2020. Net loss amounted to $12.7 million, an increase of 23% from the loss of $10.3 million reported a year ago.

Cash flow from operations was $13.3 million in the first quarter of 2021, compared to a loss of $0.8 million in the prior-year quarter. The cannabis operator had a cash balance of $234 million at the end of the quarter, which will be used to support future growth initiatives.

TerrAscend’s Executive Chairman Jason Wild said, “In Q1, we drove strong revenue growth, margin expansion, and cash generation by continued focus on operational excellence, disciplined cost control, and effective allocation of capital. I’m pleased with the strong results our team has delivered to begin the year.”

“Looking ahead to the rest of the year, there are strong operational tailwinds helping our business as we continue to see the benefits from recently completed cultivation expansions, and the addition of retail locations in New Jersey, Pennsylvania, and Maryland,” added Wild.

In addition, TerrAscend raised its FY 2021 forecast. It now expects sales to exceed $300 million and Adjusted EBITDA to exceed $128 million. (See TerrAscend Corp stock analysis on TipRanks)

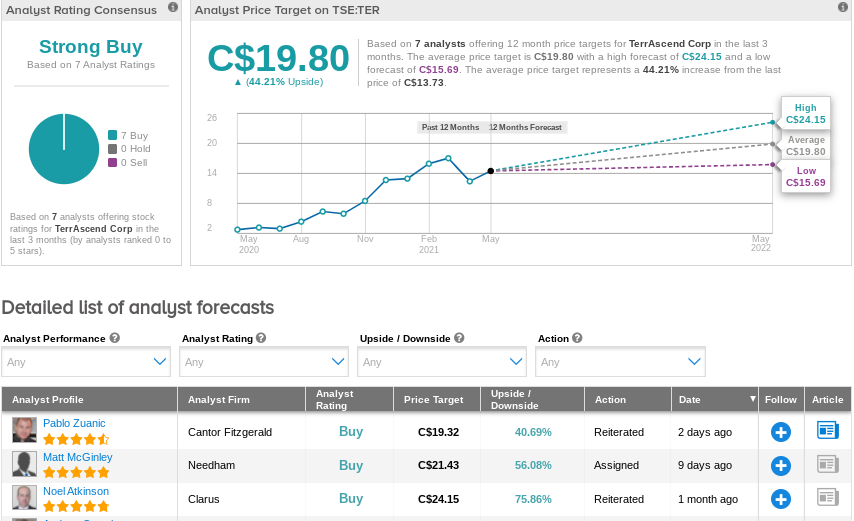

On May 17, Cantor Fitzgerald analyst Pablo Zuanic maintained a Buy rating on TER and a $16.00 price target (C$19.32), for 40.7% upside potential.

According to Zuanic, TerrAscend operated three stores in Pennsylvania during the first quarter, and the state only achieved 70% of Q4 sales during the period. Other states look promising, with New Jersey still in “ramp-up mode.” In California, the company may move from its fifth store added in the fourth quarter.

Overall, consensus on the Street is that TER is a Strong Buy based on 7 Buys. The average analyst price target of C$19.80 implies 44% upside potential to current levels. Shares have gained approximately 9% year-to-date.

Related News:

Verano Holdings Posts 117% Sales Growth in Q1

MediPharm Labs Reports a Dismal First Quarter

HEXO to Acquire 48North Cannabis for C$50M