Tencent Music Entertainment Group announced a stock repurchase program of up to $1 billion that it intends to fund from its current cash balance. The repurchases of its Class A ordinary shares in the form of American Depositary Shares (ADS) commenced on March 29 and will be completed over the next twelve months. Shares of the China-based online music entertainment platform rose more than 7% in the pre-market session.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Tencent’s (TME) Chairman of the Board Mr. Tong Tao Sang said, “The Share Repurchase Program is a strong indication of the Board’s confidence in the Company’s business outlook and long-term strategy, and we believe it will ultimately benefit TME and create value for its shareholders.”

Last week, the company reported 4Q results. Total revenues of $1.28 billion (RMB8.34 billion) increased 14.3% from the year-ago period. Tencent posted earnings per ADS of $0.12 (RMB0.80), which were flat year-over-year. Results met analysts’ expectations. (See Tencent stock analysis on TipRanks)

On March 25, Needham analyst Vincent Yu reiterated a Buy rating and a price target of $25 (24.4% upside potential) on the stock.

Yu believes “TME’s dominant position, its focused strategy to drive paying-user growth, and new initiatives such as audiobooks, podcasts, and new ads programs, will drive its future growth.”

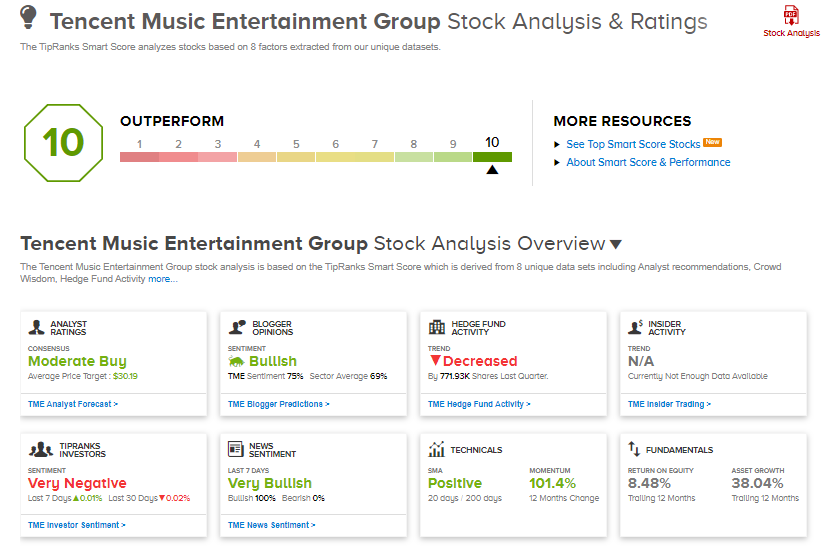

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 7 Buys, 3 Holds, and 1 Sell. The average analyst price target of $30.19 implies 50.2% upside potential to current levels. Shares have increased 35% over the past six months.

Tencent scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Catalyst Pharma To Buy Back $40M In Stock; Shares Gain Pre-Market

AutoZone To Buy Back $1.5B In Stock

Saratoga Investment Bumps Up Quarterly Dividend