Shares of the ASX-listed Telstra Corporation Limited (AU:TLS) offer an attractive dividend yield of nearly 5%, exceeding the sector average of 2.54%. Going forward, the company plans to enhance its fully franked dividends as part of its capital management strategy.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In terms of capital appreciation, analysts are moderately optimistic about the stock, forecasting a very small upside from current levels. Year-to-date, TLS stock has witnessed only a 1% gain.

Telstra Group offers a complete range of communication and technology services in Australia. Its mobile segment is the largest in the country, with the widest user base and coverage.

TipRanks Offers Dividend Tools for Investors

TipRanks provides various tools to help users find dividend stocks that suit their preferences. In this case, we utilized the TipRanks Best Australian Dividend Shares tool, which offers a detailed list of high-dividend-paying companies and other relevant parameters.

Additionally, tools like Dividend Calendar screen and display stocks based on their upcoming payment dates.

What is the Dividend for Telstra in 2024?

For the second half of FY24, Telstra announced a fully franked final dividend of AU$0.09 per share. This, combined with the franked interim dividend of AU$0.09 per share led to a total dividend of AU$0.18 for FY24. The FY24 dividend marks a growth of 5.8% over the total dividend of AU$0.17 paid last year.

Telstra Reports Mixed FY24 Results

Last month, Telstra reported its FY24 results, driven by robust revenue growth in its Mobile division. Mobile services revenue increased 5.6%, while average revenue per user grew around 2.1%. In FY24, the company gained 560,000 new customers, with its network now supporting 26 million mobile services.

On the flip side, the company’s NPAT (net profit after tax) decreased 12.8% to AU$1.8 billion due to higher costs incurred in the Enterprise business.

Is Telstra a Good Stock to Buy?

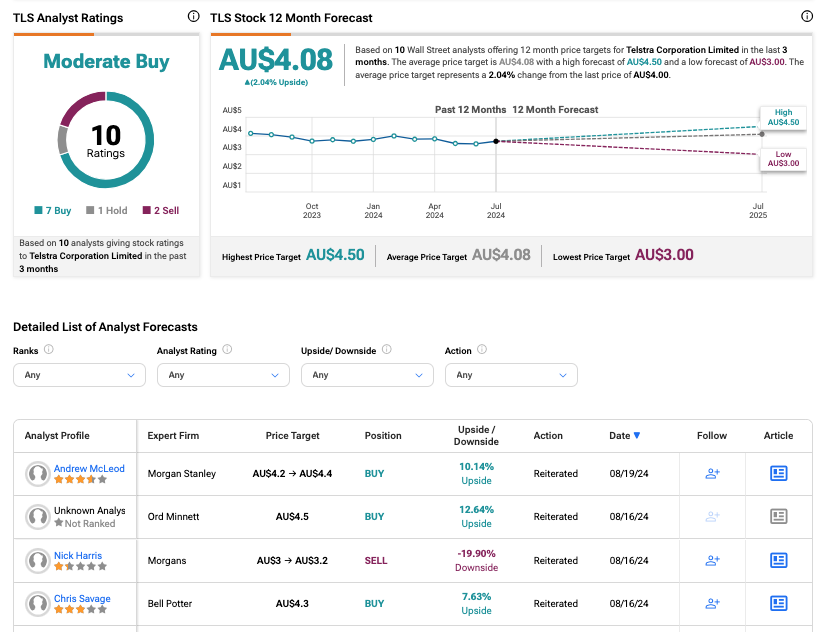

According to TipRanks’ rating consensus, TLS stock has received a Moderate Buy rating based on seven Buys, one Hold, and two Sell recommendations. The Telstra share price target is AU$4.08, which is 2.04% above the current price level.