The mid-size oil tanker market has thrived thanks to robust oil demand, prolonged voyage lengths due to geopolitical tensions, and a tight balance of supply due to limited fleet growth – trends expected to persist in the near term. Oil transport company Teekay Tankers (NYSE:TNK) has flourished, presenting an attractive value investment opportunity, with revenues and earnings hitting all-time highs.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The stock is up over 420% in the past three years, and after another strong earnings report, the shares continue to climb. Despite the recent rise in price, the stock trades at a relative discount, making it an attractive option for value investors.

Teekay’s Attractive Market Dynamics

Teekay is a provider of international crude oil marine transportation. The company manages roughly 64 marine assets, including tankers and vessels, for the Australian government. It serves a broad base of energy companies through its extensive global presence, including offices in eight nations and a workforce of approximately 2,200 marine and onshore employees.

With ongoing attacks on merchant shipping in the Red Sea area, ship owners and operators have chosen to circumnavigate the hazard, opting for lengthier routes that significantly expand voyage time. This has limited the supply of available tankers and driven up prices.

Further, demand forecasts from major oil agencies project robust growth in oil demand, estimating an increase of 1.5 million barrels per day in 2024 and 2025. A significant part of this demand increase is anticipated to be catered to by non-OPEC nations, particularly those in the Atlantic Basin. This implies that the demand for tanker ton-mile will continue to rise, driven by an uptick in long-haul movements from the Atlantic Basin to Asia.

Analysis of Teekay’s Recent Financial Results

For the first quarter of 2024, the company reported a revenue of $338.34 million, significantly surpassing the consensus estimate of $221.55 million. Adjusted net income of $132.3 million drove an EPS of $3.82 per share, slightly beating the consensus of $3.73.

In March 2024, the company completed the repurchase of eight vessels for a total of $137.0 million, making it debt-free. The company also declared a cash dividend of $0.25 per share and a special dividend of $2.00 for the March 31, 2024 quarter.

Is TNK Stock a Buy?

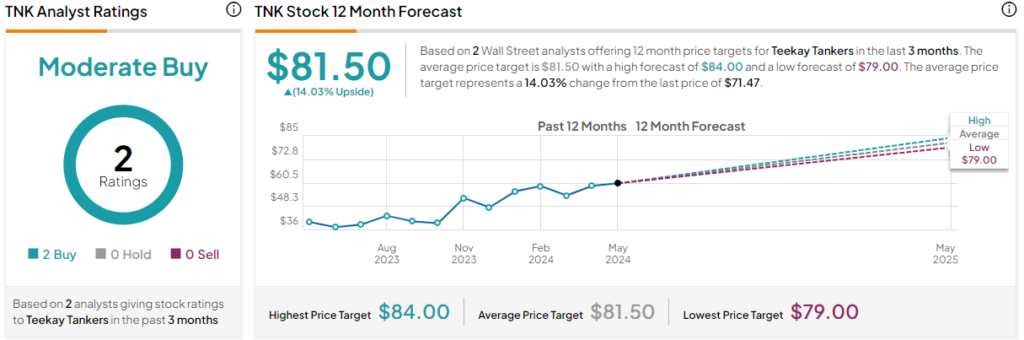

Analysts following the company are bullish on the stock. Evercore ISI analyst Jonathan Chappell recently raised the share price target from $73 to $84 while maintaining an Outperform rating. He noted the expanding revenue and likely EPS upside in the near and long term.

Teekay Tankers is rated a Moderate Buy based on the recommendations and 12-month price targets two Wall Street analysts issued in the past three months. The average price target for TNK stock is $81.50, representing a 14.03% upside from current levels.

The stock has been trending upward, climbing over 20% in the past month. It trades at the high end of its 52-week price range of $35-$71.49 and continues to show positive price momentum, trading above the 20-day (62.30) and 50-day (59.31) moving averages. Despite the strong price run-up, the stock trades at a relative discount, with a P/E ratio of 5x sitting well below the Oil & Gas Midstream industry average of 12.5x.

Final Thoughts on TNK

Teekay Tankers enjoys favorable market dynamics that have driven substantial revenue and earnings growth and offer the potential to continue doing so. The stock continues to display positive momentum, though it still trades at a value, making it an attractive combination. Investors looking for a stock offering growth potential at a reasonable price might find this one compelling.