Teck Resources (TECK.B) posted higher revenues and profits in the third quarter of 2021, helped by strong commodity prices. The Canadian mining company specializes in the extraction, processing and distribution of lead, zinc, and coal.

Revenue came in at C$3.97 billion in the quarter ended September 30, an increase of 73.4% from C$2.29 billion in the third quarter of 2020. Adjusted EBITDA hit a record C$2.1 billion, more than triple the same period last year.

Profit attributable to shareholders was C$816 million (C$1.53 per share) in Q3 2021, compared with a profit of C$61 million (C$0.11 per share) in Q3 2020.

On an adjusted basis, Teck Resources earned C$1.02 billion (C$1.88 per share) in the third quarter, up 680.8% from C$130 million (C$0.24 per share) a year ago.

Analysts’ average estimate for adjusted EPS was C$1.50, according to financial market data firm Refinitiv. (See Insiders’ Hot Stocks on TipRanks)

Teck Resources president and CEO Don Lindsay said, “The extremely favourable commodity price environment – particularly for steelmaking coal – combined with solid operational performance resulted in record quarterly adjusted EBITDA and record adjusted profit in the third quarter. Heading into the fourth quarter, we are focused on continuing to optimize sales and production to capitalize on high commodity prices and advancing our priority QB2 copper project.”

On October 20, TD Securities analyst Greg Barnes maintained a Buy rating on TECK.B with a price target of C$47. This implies 35.5% upside potential.

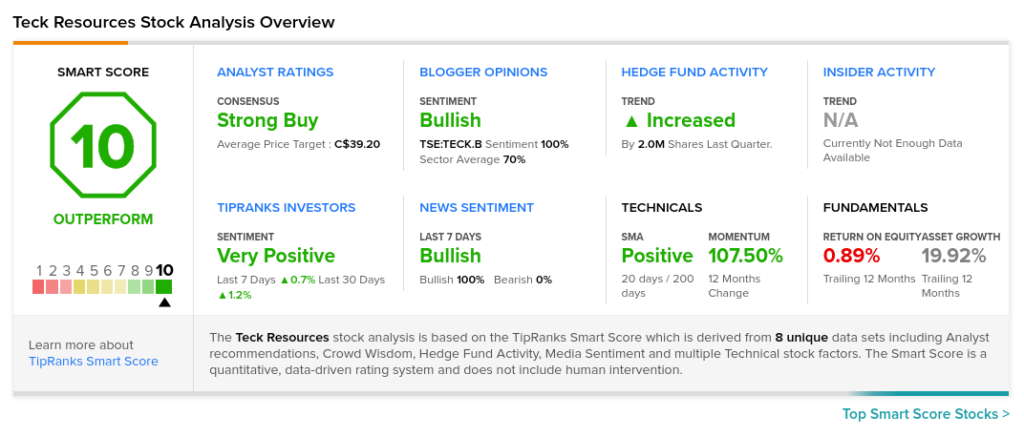

Overall, the consensus on the Street is that TECK.B is a Strong Buy based on 14 Buys and four Holds. The average Teck Resources price target of C$39.25 implies an upside potential of 13.5% to current levels.

TipRanks’ Smart Score

TECK.B scores a “Perfect 10” on the TipRanks Smart Score rating system, indicating that the stock returns have strong chances to beat the overall market.

Related News:

West Fraser to Buy Georgia’s Pacific OSB Mill

Canadian Pacific Q3 Profit Drops 20%, Misses Estimates

CN Rail Q3 Profit Surges; Shares Soar