When the big money decides to move its funds around, retail investors should pay attention. Given a recent shift from risk-on assets to a flight to safety (more on that below), utility giant Duke Energy (NYSE:DUK) could represent an intriguing opportunity. Fundamentally, utility players – especially giants like Duke (which focuses on electrical and gas utilities) – benefit from a natural monopoly. As such, I am bullish on DUK stock for the confidence it provides.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

DUK Stock Is an Ideal Play as Big Dogs Exit Tech

Arguably, in almost any circumstance, DUK stock is a tremendously relevant investment. Obviously, people need power and critical resources to survive and thrive in the modern world. So, no matter what happens in the market or the broader economy, Duke presents an indelible service. And this narrative becomes even more compelling when one considers the tech outflow.

According to a Reuters report last month, tech stocks saw a $4.4 billion outflow over the course of a one-week period. That was the largest outflow ever recorded, which is obviously notable. Sure, some of this record print stems from an arithmetic trick. With many innovative firms soaring thanks to artificial intelligence, any big outflow would likely have a solid chance of representing an all-time high.

However, the exit from the tech ecosystem also presents a warning sign that may benefit DUK stock. If the big dogs continued to invest in innovation, it would translate to one logical outcome: they believe the underlying securities can rise still.

Granted, when a pullout occurs, it’s not necessarily because investors are bearish. It’s always a good idea to trim the tree because anything can happen in the market. That said, it’s more than possible that the smart money sees higher risks associated with staying aboard tech plays than transitioning to risk-off investments.

Because the smart money typically enjoys the most resources and access to the best information, it’s not a bad idea to follow its lead. Per Reuters, money also flowed into investment-grade bonds and cash equivalents. That’s an awfully conservative approach.

Instead, retail investors may choose a happy medium. DUK stock benefits from an underlying permanently relevant business that provides a mixture of capital gains potential and passive income.

The Middle of Two Extremes

While the tech-centric Nasdaq Composite is up around 11% since the beginning of the year, it gained less than 1% in the trailing month. So, continuing to bet on tech ideas seems risky. On the other hand, going to cash also seems risky (from an opportunity cost perspective) amid a relatively robust economy. Thus, DUK sits in the middle of two extremes.

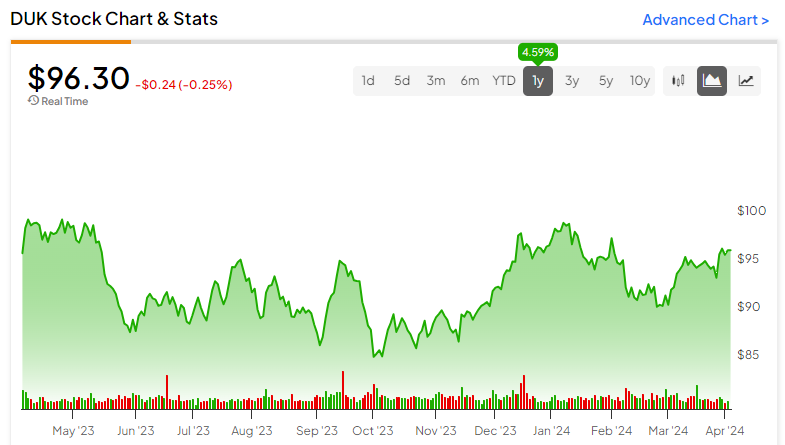

Yes, DUK’s financials last year weren’t all that hot. Specifically, the average positive earnings surprise in the last four quarters sat at 3.2% below breakeven. Perhaps not surprisingly, DUK stock only moved up a 4.6% in the past 52 weeks.

Nevertheless, analysts anticipate a solid fiscal year for Duke Energy. They project earnings per share to be $5.97 on revenue of $30.18 billion. In contrast, last year’s print was earnings of $5.56 per share on sales of $29.06 billion.

What’s more, the most optimistic target calls for EPS of $6.02 on revenue of $32.05 billion. Fundamentally, the actual numbers could land closer to the most bullish side of the spectrum. How so? It comes down to geography.

Headquartered in North Carolina, Duke covers the Carolinas, Indiana, Ohio, Kentucky, and Florida. Because of the dramatic rise in the costs of living in coastal metropolitan areas, more young people are moving to these states. Notably, North Carolina is one of the most-migrated-to states for millennials.

Why does that matter? Simply, Duke operates where the consumer base — the addressable market — is expanding. So, it’s absolutely reasonable to believe that Duke will hit the higher end of the analyst projections.

Factor in the company’s dividend yield of 4.2% — a payout that’s been increasing over the past 19 years — and DUK stock is giving investors plenty of reassurance.

DUK Stock’s Valuation

Currently, DUK stock trades at a trailing-year sales multiple of 2.56x. This figure stems from dividing the share price ($96.30) from its revenue per share (RPS). RPS stems from dividing 2023 revenue ($29.06 billion) from the shares outstanding on a diluted average basis (771 million). That’s a bit overvalued compared to the electric utilities sector average P/S ratio of 2.1x.

However, if Duke hits the high end of estimated 2024 sales ($32.05 billion), and assuming the same share count, the forward sales multiple would land at around 2.3x. That’s not exactly a bargain rate, but it makes DUK stock more attractive. Further, with the geographic advantage, this favorable valuation adjustment appears justified.

Is Duke Energy Stock a Buy, According to Analysts?

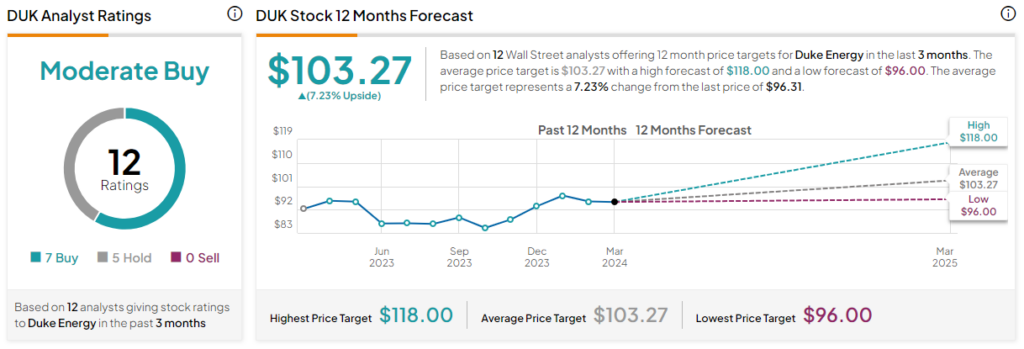

Turning to Wall Street, DUK stock has a Moderate Buy consensus rating based on seven Buys, five Holds, and zero Sell ratings. The average DUK stock price target is $103.27, implying 7.23% upside potential.

The Takeaway

With the big money moving away from tech securities and into cash and similarly conservative ideas, this dynamic represents a warning sign. It’s worth heeding, but retail investors may want to adopt a middle-ground approach with Duke Energy. Fundamentally, DUK stock benefits from a permanently relevant business — one that’s expanding. Therefore, this utility play is more attractive than its stock performance suggests.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue