TE Connectivity (TEL) announced that its board has approved a recommendation to raise quarterly cash dividend by approximately 4.2% to $0.50 per share. The connectivity and sensor product manufacturer said that its board will present the recommendation at its annual shareholder meeting scheduled on Mar. 10, 2021, for approval.

The planned dividend hike would represent an annual dividend of $2 per share and translate into an annualized dividend yield of approximately 1.7%.

TE Connectivity said that quarterly cash dividend hike will be applicable for “the four fiscal quarters starting in April 2021, the beginning of the third fiscal quarter.” (See TEL stock analysis on TipRanks)

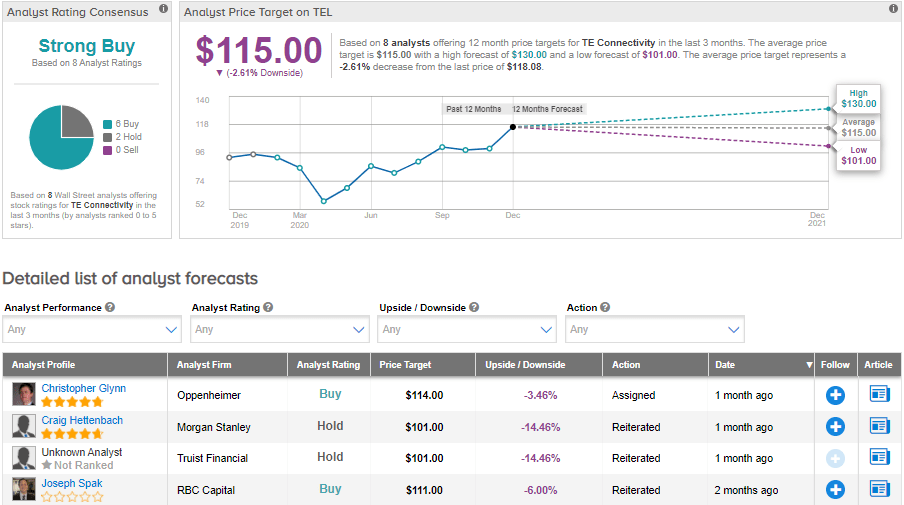

On Oct. 30, Oppenheimer analyst Christopher Glynn reiterated a Buy rating and price target of $114 (3.5% downside potential). In a note to investors, Glynn wrote that our “rating reflects our view of extending track record of long-term revenue and margin execution. TEL looks increasingly well positioned for long-term solid organic growth prospects via global positioning against secular demand expansion for high-quality connectivity assurance.”

Overall, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 6 Buys and 2 Holds. The average price target stands at $115 and implies downside potential of about 2.6% to current levels. Shares have gained 23.2% year-to-date.

Related News:

Abbott Ramps Up Quarterly Dividend By 25%; Street Bullish

PotlatchDeltic Hikes Dividend; Street Sees 9.1% Upside

Cognex Gains On Special Cash Dividend; Street Sees 8% Downside