Nvidia (NASDAQ:NVDA) shares have seen insatiable demand from investors over the past couple of years, propelling the chip giant to become one of the biggest companies in the world. This enthusiasm is mirrored by customers, who who have been gobbling up Nvidia’s AI-ready products at a rapid pace.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

But for how long can the company sustain the huge growth spurt? According to Cowen analyst Joshua Buchalter, investors are starting to weigh this as they look ahead to the January quarter, especially given concerns about potential risks to Nvidia’s impressive streak of substantial beat-and-raise earnings, which may be impacted by previous delays in the production of its Blackwell platform.

So, do investors need to be concerned here? Not according to Buchalter.

“All eyes on the JanQ guide, but we see Hopper demand sufficiently bridging any gap as Blackwell ramps,” the analyst said. “We think this ramp has begun but is difficult to precisely time/model given the artificial JanQ/AprQ boundary. We see no change to prevailing demand dynamics across AI spend as risk of underinvestment continue to outweigh those from over.”

Fact is, Buchalter says that he has actually noticed a rise in Hopper volumes for the second half of 2024 and believes the uptick will likely support continued strong growth during the period. Additionally, this situation could have a favorable impact on gross margins, as the company has indicated that the less developed Blackwell supply chain may pose a short-term “margin headwind.”

In any case, with demand for Blackwell platforms still “unabated,” Buchalter thinks that any delays will simply result in upside being pushed out from the January quarter to the April and July quarters.

Moreover, as pointed out in recent statements by the company, the Blackwell platforms are now in “full production,” implying that the underlying issue plaguing production has probably been worked out. “More broadly,” Buchalter goes on to add, “we believe the major companies in AI (hyperscale cloud companies and large sovereigns) face an investment environment characterized by a Prisoner’s Dilemma—each is individually incentivized to continue spending, as the costs of not doing so are (potentially) devastating.”

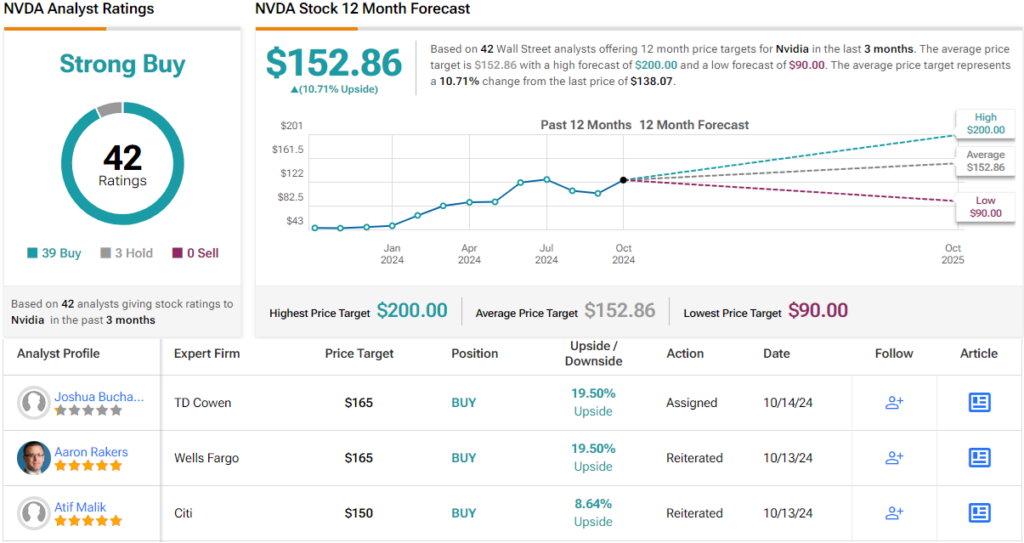

Ultimately, Buchalter rates NVDA as a Top Pick, reaffirming his Buy rating with a $165 price target. The implication for investors? Upside of 22% from current levels. (To watch Buchalter’s track record, click here)

That is hardly a controversial take on Wall Street as 38 other analysts join Buchalter in the bull camp, thoroughly outpacing 3 Holds, and naturally resulting in a Strong Buy consensus rating. The forecast calls for 12-month returns of ~11%, based on an average price target of $152.86. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.