Toronto Dominion Bank (TD) (TSE:TD) is expected to pay about $3 billion in penalties and face restrictions on its U.S. growth due to a regulatory settlement over anti-money laundering failures, the Wall Street Journal reported. This settlement involves the Canadian bank’s U.S. unit, which is expected to plead guilty to the charges on Thursday.

The settlement is related to an investigation by U.S. authorities into TD Bank’s internal controls and its failure to detect and prevent money laundering activities linked to drug cartels. It is worth mentioning that the probe involved several regulatory agencies, including the Department of Justice (DoJ), the Financial Crimes Enforcement Network (FinCEN), the Office of the Comptroller of the Currency (OCC), and the Federal Reserve.

As part of the settlement, the OCC is expected to impose a cap on TD’s U.S. retail banking assets, thereby limiting its ability to expand operations in the country. Additionally, both the DOJ and the FinCEN are likely to appoint independent monitors to oversee the bank’s operations and ensure compliance with the settlement terms for four years.

Stock Rises 14%, But Regulatory Challenges Ahead

It is worth mentioning that the stock has gained 14% over the past three months. The upside can be attributed to the bank’s strong financials. For example, the company’s adjusted revenue and earnings grew by 10% and 5%, respectively, in the most recent third quarter. Additionally, investors welcomed the announcement of CEO Bharat Masrani’s retirement, which was revealed last month amid the ongoing investigation.

However, the regulatory fallout may weigh on its recent impressive share price performance.

Is TD Bank Stock a Good Buy?

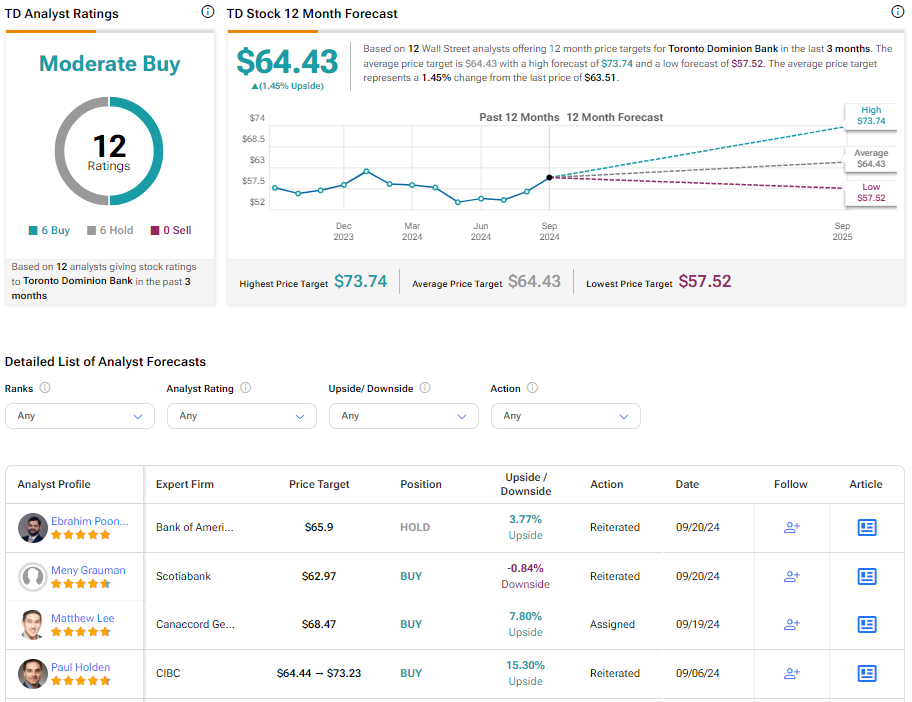

Turning to Wall Street, TD stock has a Moderate Buy consensus rating based on six Buys and six Holds assigned in the last three months. At $64.43, the average TD Bank price target implies a 1.45% upside potential.