Toronto-Dominion Bank (NYSE:TD) (TSE:TD), one of Canada’s largest banks, released its Q3-2023 financial results earlier today. The bank slightly missed earnings estimates, sending the stock lower. TD’s adjusted diluted earnings per share (EPS) were C$1.99, missing the consensus estimate of C$2.04 and lower than last year’s EPS of C$2.09. For the first nine months of TD’s fiscal year, adjusted diluted EPS came in at C$6.16, two cents lower year-over-year.

TD Bank Group also intends to terminate its current program to buy back 30 million shares after its completion and plans to initiate a new one, aiming to repurchase as much as 90 million shares, or approximately 4.9% of its total share count as of July 31, 2023.

How Each Segment Performed

Delving into the details, TD’s Canadian Personal and Commercial Banking arm saw an increase in revenue by 7%, reaching C$4.57 billion. However, net income took a slight dip of 1% from last year, primarily attributed to increased provisions for credit losses. Further, the U.S. Retail Banking segment reported a 6% decrease in adjusted net income.

Similarly, the Wealth Management and Insurance segment saw a 12% drop in net income due to “higher insurance claims and related expenses.” On the other hand, Wholesale Banking net income stayed flat year-over-year.

Is TD Stock a Buy, According to Analysts?

According to analysts, TD stock comes in as a Moderate Buy based on seven Buys and three Holds assigned in the past three months. The average TD stock price target of C$91.57 implies 12% upside potential.

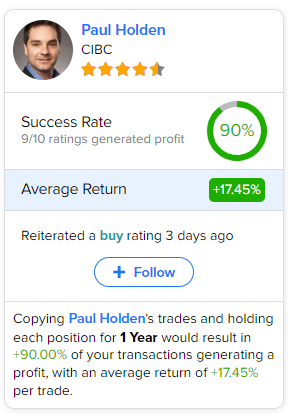

If you’re wondering which analyst you should follow if you want to buy and sell TD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Paul Holden of CIBC, with an average return of 17.45% per rating and a 90% success rate. Click on the image below to learn more.