Taylor Morrison Home Corporation (TMHC) announced an increase of its share buyback program to $250 million with an extended timeline to December 31, 2022. Shares rose 1% to close at $29.91 on June 1.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Taylor Morrison engages in the business of residential home building and the development of lifestyle communities.

Under the program, the company plans to buy back shares from time to time in the open market or through private negotiations, subject to market conditions and other considerations.

The company has already repurchased around 37 million shares worth $735 million since 2015, which represents 31% of its outstanding shares. (See Taylor Morrison stock analysis on TipRanks)

Taylor Morrison’s CFO Dave Cone said, “Our strong outlook for operating cash flow has equipped us with flexibility to continue to invest in our business, drive further balance sheet deleveraging and return excess capital to shareholders via share repurchases.”

On April 29, TMHC reported Q1 earnings in line with the Street’s estimates of $0.75 per share but revenue of $1.42 billion missed analysts’ expectations of $1.47 billion.

Following the results, Barclays analyst Matthew Bouley lifted the price target on the stock to $40 (33.7% upside potential) from $39 while maintaining a Buy rating.

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 3 Buys and 3 Holds. The average analyst price target of $38.10 implies 27.4% upside potential to current levels. Shares have gained 51.8% over the past year.

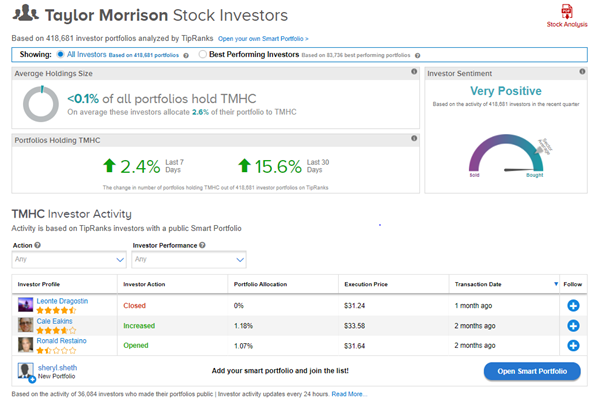

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on TMHC, with 15.6% of investors increasing their exposure to TMHC stock over the past 30 days.

Related News:

Esports Entertainment Signs Multi-Year Deal as LAFC’s Esports Tournament Platform Provider

NIO Vehicle Deliveries Fall 5.5% in May; Street Remains Bullish

Canopy Growth Posts 38% Revenue Growth in Q4, Miss Estimates; Shares Fall 1%