Big-box retailer Target (TGT) will release its Q2 2024 financials on August 21. Analysts forecast that the company will report earnings of $2.18 per share, up 21.1% from the same quarter last year. Meanwhile, analysts expect revenues of $25.19 billion, reflecting a 1.7% year-over-year increase, according to TipRanks’ data.

In terms of share price growth, TGT stock increased 16% over the past year and 3% year-to-date. Interestingly, Target has a decent earnings surprise history. The company exceeded earnings estimates in five out of the previous six quarters.

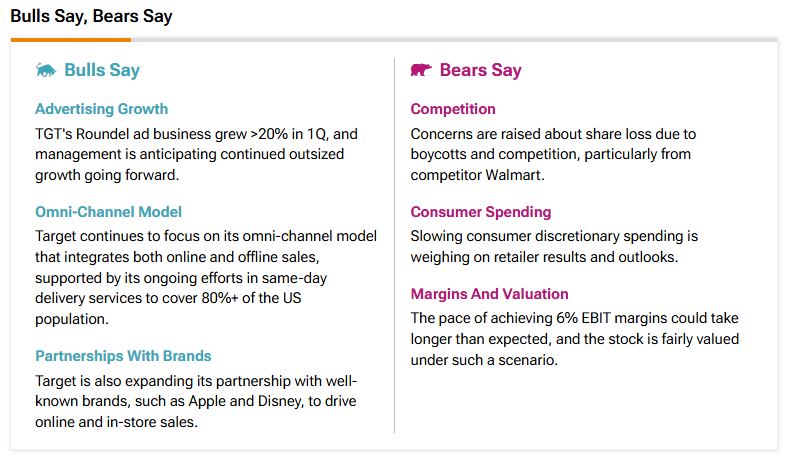

Insights from the TipRanks Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool pictured below, bulls are optimistic about Target, noting the over 20% growth of its Roundel ad business in Q1 and expecting continued expansion. They stay positive about Target’s omni-channel model, which integrates online and offline sales. Analysts believe that partnerships with brands like Apple (AAPL) and Disney (DIS) will keep driving both online and in-store sales.

Meanwhile, bears are concerned that Target might lose market share due to boycotts and increasing competition, particularly from Walmart (WMT). They also point out that the slowdown in consumer discretionary spending is affecting both retailer performance and future outlooks.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 7.85% move in either direction.

Is Target a Good Stock to Buy Right Now?

Overall, the Street has a Moderate Buy consensus rating on TGT stock, alongside an average price target of $173.73. However, analysts’ views on the stock are likely to change once the company reports its Q2 earnings tomorrow.