Target (NYSE:TGT) is targeting budget-conscious consumers! The retailer has announced that it will lower prices on over 5,000 frequently shopped items, from milk to diapers, to attract budget-conscious customers. High food prices and rising borrowing costs are leading shoppers to seek cheaper options, prompting retailers to cut prices to draw them in.

Target is facing stiff competition from Walmart (NYSE:WMT), which is already offering products at lower prices.

Furthermore, Target plans to cut prices on meat, bread, soda, fruit, vegetables, snacks, and yogurt in various markets. Currently, the retailer has slashed prices on about 1,500 items, including frozen chicken breast and shredded cheese, among others, with more price cuts planned over the summer.

Target’s chief food officer, Rick Gomez, commented, “We know consumers feel pressured to maximize their budget.” The company’s price cuts will apply to both national brands and Target’s private brands, in addition to Memorial Day discounts.

Separately, the company is expected to report its first-quarter results on May 22.

What Is the Future of TGT Stock?

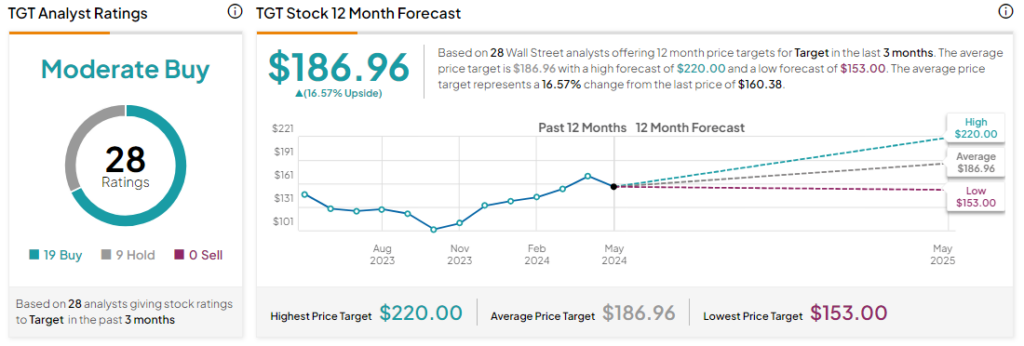

Analysts remain cautiously optimistic about TGT stock, with a Moderate Buy consensus rating based on 19 Buys and nine Holds. Year-to-date, TGT has increased by more than 10%, and the average TGT price target of $186.96 implies an upside potential of 16.6% from current levels.