Retailing giant Target (NYSE:TGT) surged in pre-market trading after the company reported adjusted earnings of $2.10 per share in the third quarter, up by 36% year-over-year and above consensus estimates of $1.47 per share.

The retailer posted total revenues of $25.4 billion, a decline of 4.2% year-over-year, but slightly higher than analysts’ estimates of $25.3 billion. Target’s overall comparable sales fell by 4.9% in the third quarter, reflecting a decline in comparable store sales of 4.6% while comparable digital sales dropped by 6%.

Brian Cornell, Target’s Chair and CEO commented, “In the third quarter, our team continued to successfully navigate our business through a very challenging external environment. While third-quarter sales were consistent with our expectations, earnings per share came in far ahead of our forecast.”

In the fourth quarter, the retailer expects “comparable sales in a wide range around a mid-single digit decline,” while adjusted earnings are likely to be in the range of $1.90 to $2.60 per share.

What is the Future of TGT Stock?

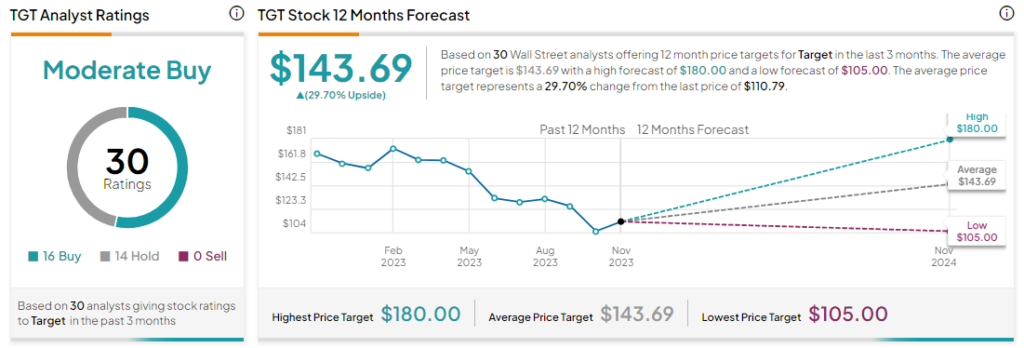

Analysts are cautiously optimistic about TGT stock with a Moderate Buy consensus rating based on 16 Buys and 14 Holds. TGT stock has dropped by more than 20% year-to-date even as the average TGT price target of $143.69 implies an upside potential of 29.7% at current levels.