Talen Energy (TLN) and Amazon (AMZN) shares fell over 2% and 1%, respectively, on Monday. The decline came after the U.S. Federal Energy Regulatory Commission (FERC) denied a request to increase the power supply from TLN’s Susquehanna nuclear plant to AMZN’s data center campus. This comes as major tech companies turn to nuclear energy to power their growing artificial intelligence (AI) operations.

The FERC raised concerns that the deal could lead to higher electricity costs for consumers and might affect grid reliability. While Talen disagreed with the decision, the company stated it is exploring alternative solutions, focusing on commercially viable options.

Importantly, this decision has affected the nuclear industry, causing stock prices for major firms like Constellation Energy (CEG) and Vistra (VST) to drop by over 12% and 3%, respectively. This is because these nuclear power producers were eyeing similar deals to supply energy for tech companies’ data centers. The FERC decision may now limit their plans to benefit from the growing energy demand.

Rising Nuclear Power Demand in the Tech Sector

With AI advancing and data centers expanding, the demand for reliable energy will only increase. Nuclear power, known for its low-carbon footprint and high energy density, remains a promising option to meet these needs.

In response, major tech companies are exploring partnerships with nuclear power plant operators. For instance, in September, Microsoft (MSFT) signed a power purchase agreement with Constellation Energy to support its AI applications.

However, the FERC’s decision to reject the Amazon-TLN agreement highlights the regulatory challenges that companies may encounter as they work to expand their AI operations.

Is Talen Energy Stock a Buy?

Turning to Wall Street, TLN stock has a Strong Buy consensus rating based on eight Buys assigned in the last three months. At $217.75, the average Talen price target implies a 28.09% upside potential. Shares of the company have gained 165.6% year-to-date.

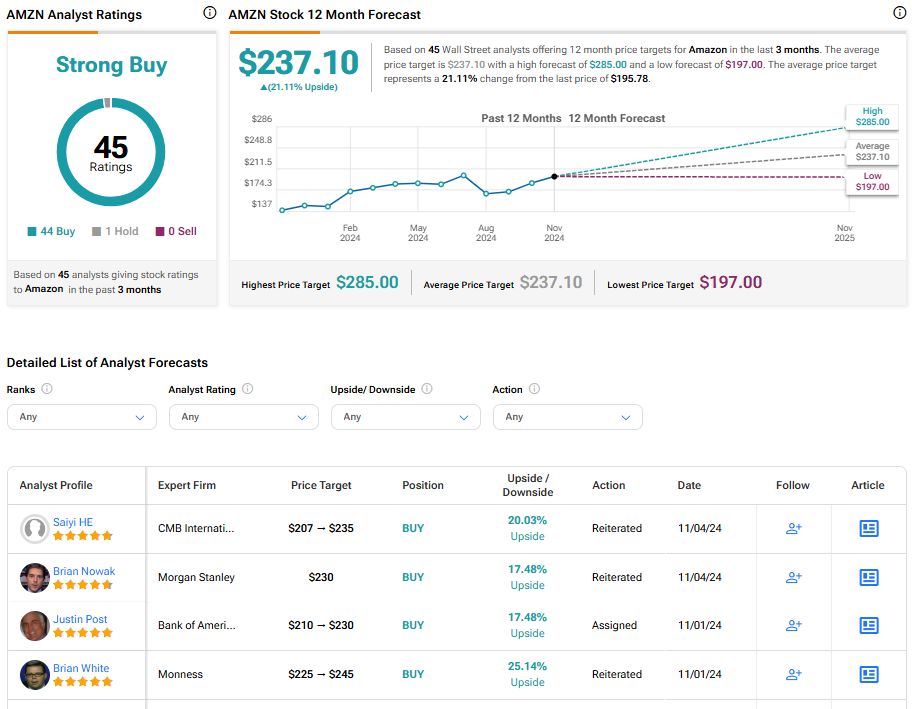

Is AMZN a Good Stock to Buy?

Overall, AMZN stock has a Strong Buy consensus rating based on 44 Buys and one Hold assigned in the last three months. At $237.10, the average Amazon price target implies a 21.11% upside potential. Shares of the company have gained 28.85% year-to-date.