Marine Products Corp. (MPX) provides premium branded Chaparral sterndrive and outdrive pleasure boats and Robalo outboard sportfishing boats. Last week, Marine Products posted robust Q2 results.

Let’s take a look at the financial performance of the company and what has changed in its key risk factors that investors should be aware of.

On the back of 59% growth in the number of units sold, along with a 7.5% increase in average selling price, Marine Products’ revenue increased 64.8% year-over-year to $67.26 million.

Higher production and favorable model mix offset an increase in selling, general and administrative (SG&A) expenses of the company, which, in turn, helped it increase operating profit by 255% year-over-year to $7.36 million. Consequently, earnings per share of the company surged to $0.17 versus $0.05 a year ago.

The President and CEO of Marine Products, Richard A. Hubbell, said, “The extraordinarily high demand for our products has continued unabated, and we expect it to remain so beyond the 2021 retail selling season.” (See Marine Products stock chart on TipRanks)

Now, let’s look at what has changed in the company’s key risk factors profile.

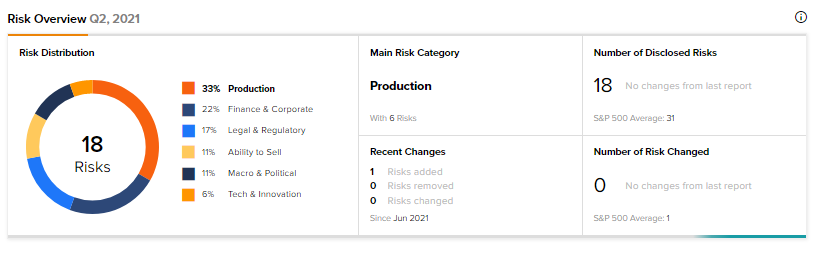

According to the new Tipranks’ Risk Factors tool, Marine Products’ main risk category is Production, which accounts for 33% of the total 18 risks identified. Since June, the company has added one key risk factor.

Under the Production category, the company acknowledges that disruptions to its supply chain have had an adverse impact on its operating and financial results. If marine Products is not able to mitigate the likelihood or potential impact of such disruptions, its business and financial condition may be negatively affected.

The Production risk factor’s sector average is at 19%, compared to Marine Products’ 33%. Shares are up 10% so far this year.

Related News:

What Do IMAX’s Risk Factors Indicate?

Vista Outdoors Shares Jump on Blowout Q1 Results

Pfizer Delivers Blowout Quarter, Raises Guidance