BTRS Holdings, Inc. (BTRS) provides cloud-based software and integrated payment processing solutions. Recently, BTRS delivered better-than-estimated second-quarter fiscal 2021 results on both revenue and earnings fronts and also raised the guidance for full-year 2021.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s look at the company’s latest financials and understand what has changed in its key risk factors that investors should know.

Net revenue in the second quarter jumped 23.2% year-over-year to $31.6 million, beating consensus estimates of $30.82 million. Notably, the total payment value (TPV), which is the dollar value of the customer payment transactions that BTRS processed on its platform, in the second quarter rose 47% year-over-year to $18.8 billion.

The Founder and CEO of BTRS, Flint Lane, said, “The strong results were in part driven by a great performance from our software and payments business fuelled by our investments in sales and marketing, as well as many of the strategic investments we have made around payments and the channel.”

Moreover, BTRS’ adjusted gross margin expanded by 119 basis points to 71.7% during the quarter. Net loss per share of $0.07 was lower than analysts’ estimates of a net loss per share of $0.08. (See BTRS Holdings stock chart on TipRanks)

For full-year 2021, the company estimates revenue to be in the range of $163 million to $167 million. Adjusted EBITDA is expected between a loss of $14 million and a loss of $16 million.

On August 24, Bank of America Securities analyst Jason Kupferberg initiated coverage on BTRS with a Buy rating and a price target of $13.

Kupferberg noted that BTRS is favorably positioned to gain market share owing to its integrated B2B electronic bill payment offerings.

Based on 4 unanimous Buys, consensus on the Street is a Strong Buy for BTRS. The average BTRS Holdings price target of $16.50 implies 50.1% upside potential. Shares are down 30.4% so far this year.

Now, let’s look at what’s changed in the company’s key risk factors.

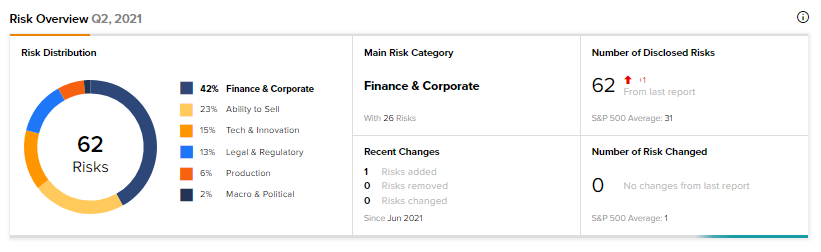

According to the new Tipranks’ Risk Factors tool, BTRS’ main risk category is Finance & Corporate, which accounts for 42% of the total 62 risks identified. Since June, the company has added one key risk factor under the Finance & Corporate risk category.

BTRS highlights that after December 31, 2021, it will not qualify as an emerging growth company (EGC), and it will have to be in compliance with higher disclosure and compliance requirements.

At present, BTRS is classified as an EGC under the JOBS act but based on the market value of its common stock held by non-affiliates exceeding $700 million as of the end of Q2 2021, it will be classified as a large accelerated filer.

Consequently, BTRS will be subject to increased compliance and disclosure requirements, which will increase its legal and financial compliance costs. This may also cause management and other personnel to divert attention from operational and other business matters. Further, if BTRS fails to comply with new requirements in a timely manner then its stock price could suffer, and the company may become subject to sanctions or investigations.

The Finance & Corporate risk factor’s sector average is at 38%, compared to BTRS’ 42%.

Related News:

What Does Western Midstream Partners’ Newly Added Risk Factor Tell Investors?

A Look at FS KKR Capital’s New Risk Factor After FSKR Merger

Taking Stock of Siebert Financial’s Risk Factors