BM Technologies Inc. (BMTX) is a digital banking platform in the U.S., providing digital banking solutions to customers and students. The company’s multi-partner distribution model allows it to acquire customers at high volumes, and lower expenses, compared to traditional banks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s take a look at its financial performance, as well as what has changed in its key risk factors that investors should be aware of. (See BM Technologies stock charts on TipRanks)

BM Technologies’ Q2 revenue jumped 48% over the previous year to $22.9 million, beating consensus of $22.12 million. It operates in three verticals, Higher Education and Student Banking, White-Label Banking, and Workplace Banking. While Higher Education and Student Banking saw 36% year-over-year growth in positive balance savings accounts, White-label and Workplace Banking saw 616% growth in average serviced deposits, and 91% growth in debit card spend.

The core EBITDA of the company jumped 11x year-over-year to $5.2 million. Core earnings were $0.10 per share, compared to a core net loss per share of $0.67 a year ago.

“We remain on track to reach our 2021 EBITDA target of $20 million to $22 million,” said BM Technologies chair, CEO, and founder Luvleen Sidhu.

On August 13, Maxim Group analyst Michael Diana reiterated a Buy rating on the stock, with a $25 price target.

“BMTX beat ‘consensus’ for revenue and adjusted EBITDA, with positive operating leverage,” said Diana. “Despite Q2 being BMTX’s seasonally weakest quarter, all growth trends were strong.”

Northland Securities analyst Michael Grondahl also has a Buy rating on the stock, with a price target of $20.

The two ratings add up to a Moderate Buy consensus rating. The average BM Technologies price target of $22.50 implies a 131% potential upside for the stock. Shares are down 34.5% so far this year.

Risk Profile

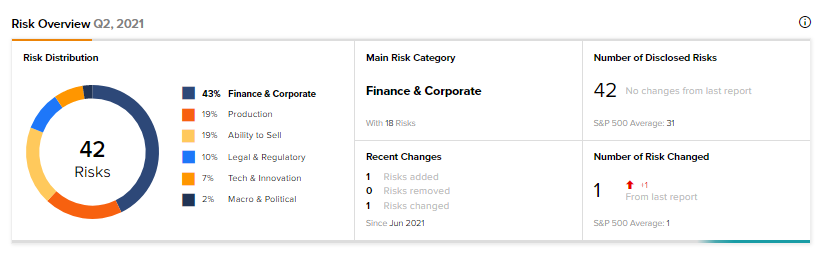

According to the new TipRanks Risk Factors tool, BM Technologies’ main risk category is Finance & Corporate, accounting for 43% of the total 42 risks identified. Since June, the company has added one key risk factor.

Under the Finance & Corporate risk category, BM Technologies acknowledged that its warrants are accounted for as liabilities, and the changes in the value of these warrants could materially impact the company’s financial results. BM Technologies added that it will recognize non-cash gains or losses on account of the quarterly fair valuation of its warrants, and such gains or losses could be significant.

The sector average Finance & Corporate risk factor is 39%.

Related News:

American Woodmark Q1 Results Miss Estimates; Shares Plunge 12%

What Do Royal Gold’s Newly Added Risk Factors Tell Investors?

A Look at Unisys’ Earnings and Risk Factors