Take-Two Interactive Software, Inc. (NASDAQ: TTWO) has successfully completed the merger of its operations with Zynga Inc. The $12.7 billion (or $9.86 per share) transaction has created a behemoth in the interactive entertainment arena.

Shares of Take-Two rose 6.5% to close at $123.62 on Monday. The stock, however, lost 2.1% in the extended trading session.

Rationale Behind the Merger

Zynga is a leader in mobile entertainment and has its business in over 175 countries. Popular offerings by Zynga include Harry Potter: Puzzles & Spells, Farmville, Toon Blast, and Merge Dragon.

The merger is expected to diversify Take-Two’s business portfolio, enhance its market presence and add a talented workforce. Moreover, costs synergies of $100 million (annually) are expected from the merger in an initial couple of years and $500 million of growth in net bookings are predicted over the years.

Talking about the financials, Take-Two has paid $3.50 cash and 0.0406 of its shares to shareholders for every Zynga share. Also, a tender offer has been made by Zynga Inc. (now a subsidiary of Take-Two) to buy its outstanding senior notes that will mature in 2024 and 2026.

Management’s Take

The Chairman and CEO of Take-Two, Strauss Zelnick, said, “We are thrilled to complete our combination with Zynga, which is a pivotal step to increase exponentially our Net Bookings from mobile, the fastest-growing segment in interactive entertainment, while also providing us with substantial cost synergies and revenue opportunities.”

Stock Rating

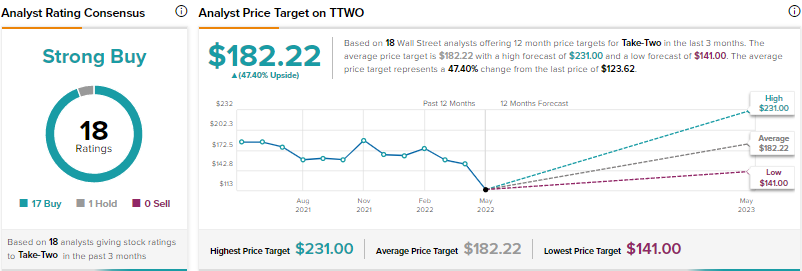

A few days ago, BMO Capital analyst Gerrick Johnson reiterated a Buy rating on TTWO with a price target of $182 (47.23% upside potential).

Overall, the Street is positive about the prospects of TTWO and has a Strong Buy consensus rating based on 17 Buys and one Hold. Take-Two’s price forecast of $182.22 suggests 47.4% upside potential from current levels. Over the past year, shares of TTWO have declined 33.2%.

Bloggers’ Stance

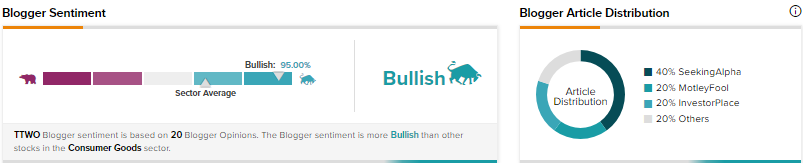

Financial bloggers on TipRanks are 95% Bullish on TTWO, as compared with the sector average of 65%.

Conclusion

Take-Two’s existing offerings, along with the recently merged businesses of Zynga, are likely to create more value for its shareholders and customers. However, resources used to make payments for the merger and any form of integration risks may raise concerns in the near term.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

GameStop Stock Reverses Gains Despite New Crypto Wallet

Meritor All Set to Expand Its Commercial Vehicle Portfolio

VMware Stock Climbing on Broadcom’s Takeover Talks

Questions or Comments about the article? Write to editor@tipranks.com