Advanced Micro Devices (NASDAQ:AMD) may not be leading the AI data center race, with Nvidia (NASDAQ:NVDA) currently dominating the market, but the old saying “to the victor belong the spoils” might not fully apply here. When it comes to the burgeoning AI revolution, AMD could still carve out its own success despite Nvidia’s current dominance.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

For now, Nvidia has cornered almost 90% of the data center market, leaving AMD far back in the dust. This gap is underscored by AMD’s stock performance, which has seen little movement over the past year, especially in contrast to the explosive gains across the broader tech sector.

However, 5-star investor Victor Dergunov believes AMD is on the cusp of a significant turnaround, with strong growth potential on the horizon.

“AMD is undervalued and poised for growth, especially in the AI segment, with the potential for better-than-expected Q3 earnings and robust future guidance,” writes Dergunov, who sits in the top 4% of all TipRanks’ stock pros.

Dergunov highlights AMD’s strategy to release new AI chips on a yearly basis, similar to Nvidia’s stated path. He also points to AMD CEO Lisa Su’s assertion that the MI350 chip is well-positioned to compete with Nvidia’s Blackwell series, suggesting AMD is serious about challenging Nvidia’s dominance in this lucrative market.

“Despite lagging Nvidia, AMD remains a top ‘picks and shovels’ player, doing the heavy lifting in the AI space,” Dergunov writes, adding that “the Nvidia/AMD gap in the AI space could narrow as we progress.”

Moreover, according to Dergunov, AMD appears attractively priced, trading “at only about 29 times next year’s consensus EPS estimates.” With shares hovering roughly a third below their 52-week high, there’s potential for a positive surprise when earnings and guidance are reported late next month.

All in all, citing AMD’s “enormous potential in the ultra-lucrative enterprise AI segment,” Dergunov gives the stock a Strong Buy rating. (To watch Dergunov’s track record, click here)

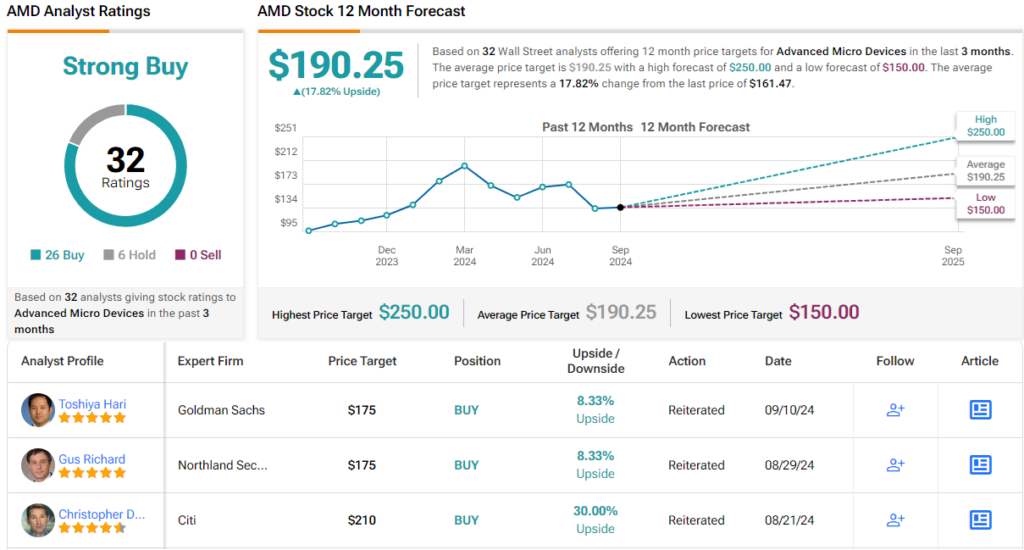

Wall Street shares this bullish outlook. Of 32 analyst ratings in the past three months, 26 rate AMD a Buy and 6 a Hold, giving the stock a consensus Strong Buy rating. With a 12-month average price target of $190.25, AMD offers ~18% upside potential. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.