Taiwan Semiconductor Mfg. Co’s (NYSE: TSM) plans to raise its chip prices have been rejected by Apple (NASDAQ: AAPL). According to a report from Economic Daily News, a Chinese news outlet, Apple, one of TSMC’s largest customers and making up around 25% of its revenues, has rejected this plan.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The report said TSMC was planning to raise the price of the process for its 3 nm process by 3% which is largely used in Apple’s iMacs in the A17 chip.

According to a Nikkei Asia report earlier this year, it was reported that TSM could be planning to raise its chip prices next year in the range of 5% to 8%. The report cited inflation, COVID-related lockdowns in China, and Russia’s war on Ukraine as the reasons behind the price hike.

Is Taiwan Semiconductor a Good Stock to Buy?

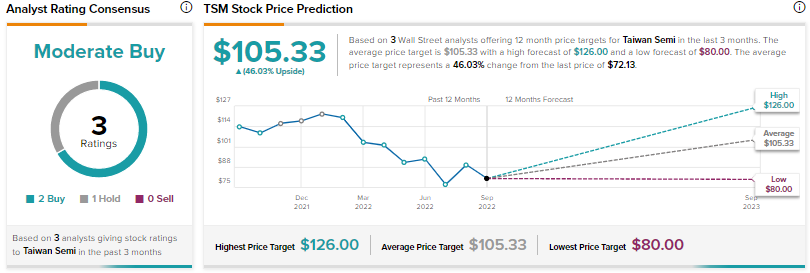

Analysts are cautiously optimistic about TSMC with a Moderate Buy consensus rating based on two Buys and one Hold.

The average price target for TSM stock is $105.33 implying an upside potential of 46%.