Last week, Taiwan Semiconductor Manufacturing (TSM), also known as TSMC, released its Q2 results, delivering its best revenue growth in six quarters. The company’s top-line growth has been on an acceleration trend, with this quarter standing out in particular. This also holds true for the bottom line, with earnings per ADR expected to reach new heights in FY2024.

Given the ongoing AI boom, which is likely to drive continued growth, and the stock’s current reasonable valuation, I remain bullish on TSM despite its prolonged rally over the past year.

3-Nanometer Boom Drives Tremendous Revenue Growth

TSM’s Q2 results exceeded Wall Street’s expectations by a wide margin, both in revenue and earnings, as its cutting-edge 3-nanometer process technology gained some serious traction. The company registered revenues of $20.8 billion, surpassing forecasts by $730 million and marking a substantial 32.8% increase year-over-year.

This quarter continued a trend of accelerating revenue growth, climbing from the prior quarterly rates of 16.5%, 0%, -10.8%, -10.0%, and 3.6%, spanning from Q1 2024 back to Q1 2023. Also, earnings per ADR exceeded estimates by $0.06, reaching $1.48.

TSM’s revenues benefited from a seasonal boost after last year’s decline, reflecting the cyclical nature of its business model. The company posted significant increases across various sectors: High-Performance Computing (HPC) surged by 28%, Digital Consumer Electronics (DCE) increased by 20%, and there were modest gains of 6% in Internet of Things (IoT) and 5% in Automotive. The slight 1% drop in Smartphone-related sales had little impact on the overall explosive performance.

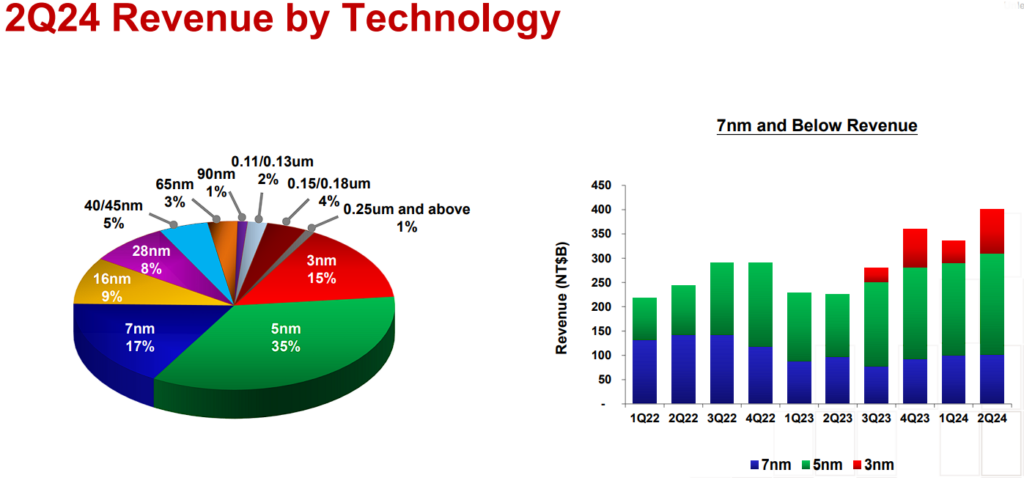

A critical factor here is the rapid adoption of 3-nanometer process technology, which has now become a significant factor in TSM’s sales mix. In fact, 3-nanometer-related revenues soared from 0% of total sales in Q1 of last year to 15% this quarter (see the image below). Management highlighted that, despite the minor decline in overall smartphone sales, there has been a substantial uptick in demand driven by AI and high-end smartphones.

This resulted in the decision for a higher capacity utilization rate for the firm’s advanced 3-nanometer and 5-nanometer technologies in the latter half of 2024. Accordingly, management remains highly optimistic about revenue growth for the full year, too.

Margins Remain Excellent Despite Cost Headwinds

TSMC’s dominant position in the semiconductor industry has enabled the company to sustain some of the most impressive profit margins in the global Tech sector. Despite facing inflationary forces, including rising electricity costs, TSM’s margins remained robust in Q2. Specifically, its gross margin, operating margin, and net margin for the period stood at 53.2%, 42.5%, and 36.8%, respectively.

While these figures may seem slightly diminished compared to last year’s 54.1%, 42.0%, and 37.8%, the primary cause is a significant 17% increase in electricity prices for industrial users in Taiwan that became effective last year. Furthermore, as of April 1st this year, TSMC’s electricity costs in Taiwan rose by another 25%, which, as we know from management’s comments in Q1’s post-earnings call, reduced this quarter’s gross margin by 70 to 80 basis points. Still, in relative terms, margins stayed at exceptionally high levels.

Valuation Remains Reasonable Against Record Earnings Potential

Despite slight margin compression due to cost headwinds, TSM’s significant revenue growth, projected to continue through the second half of the year, suggests the company is on track for record earnings per ADR (American depository receipt) in FY2024. Based on that, I find TSM stock attractively priced today.

Specifically, consensus estimates forecast earnings per ADR of approximately $6.55 for FY2024, an increase of 26.4% year-over-year and a new record for the company. This also implies a forward P/E ratio of 24.4x, a valuation I find quite appealing, especially with Wall Street anticipating another 27% increase in earnings per ADR in FY2025.

Is TSM Stock a Buy, According to Analysts?

Looking at Wall Street’s view on Taiwan Semiconductor, the stock features a Strong Buy consensus rating based on 11 unanimous Buy ratings assigned in the past three months. This is despite the stock’s massive rally over the past year. At $184.30, the average TSM stock price target implies 9.56% upside potential.

If you have yet to decide which analyst you should follow if you want to buy and sell TSM stock, the most accurate analyst covering the stock (on a one-year timeframe) is Gokul Hariharan of JPMorgan (PM), with an average return of 64.19% per rating and a 100% success rate. Click on the image below to learn more.

The Takeaway

TSM’s Q2 results marked a period of explosive growth, with its advanced 3-nanometer technology being a notable highlight. Revenues exceeded expectations, and while the company did see cost pressures from rising electricity prices, its profit margins remained particularly strong.

In the meantime, AI and high-end smartphone-related tailwinds are expected to keep driving demand in the second half of the year, with early projections for FY also appearing promising. Therefore, at 24.4x this year’s earnings per ADR today, the stock continues to present a compelling investment opportunity.