Taiwan Semiconductor Manufacturing (TSM) stock is rallying today as investors celebrate the chip and processor maker’s shares hitting a new all-time high when markets closed last week. TSM stock finished Friday at $208.61 per share after a 3.49% increase during normal trading hours. That results from consistently positive movement throughout the last 52 weeks sending shares 106.32% higher.

The new all-time high for TSM stock came with decent trading activity. 10.26 million shares changed hands, which was close to its three-month daily average of 13.59 million units.

Taiwan Semiconductor Manufacturing is ready to mark another all-time high on Monday. The stock is up 4.88% during pre-market trading this morning, and TSM shares are trading for roughly $218.80. If this positive momentum continues, it could result in additional new all-time highs this week.

What’s Behind the TSM Stock Rally?

Taiwan Semiconductor Manufacturing is among chip stocks that rallied over the last year due to an increasing interest in artificial intelligence (AI). AI requires processers as many companies have large server facilities dedicated to its use. This increases the demand for these chips and benefits semiconductor stocks with additional business.

Analysts believe this AI boom will continue in 2025 with Goldman Sachs predicting 4,180 billion NTD of revenue for Taiwan Semiconductor Manufacturing. UBS analysts also expect major revenue growth with a 25% increase in 2025. Finally, Morgan Stanley predicts TSM will beat its internal 2025 revenue guidance. These growths are expected even as investors worry about potential tariffs from the incoming Trump administration.

Is TSM Stock a Buy, Sell, or Hold

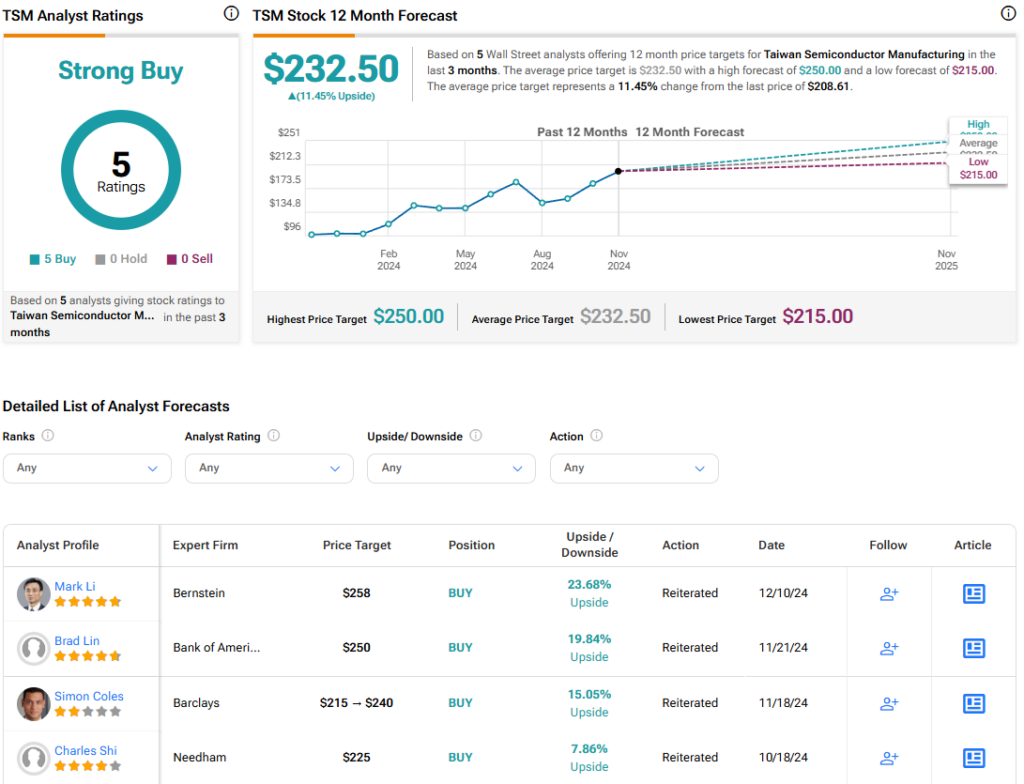

Turning to Wall Street, the analysts’ consensus rating for Taiwan Semiconductor Manufacturing is Strong Buy based on five Buy ratings over the last three months. With that comes an average price target of $232.50, a high of $250, and a low of $215. This represents a potential 11.45% upside for TSM shares.