Keith Krach, the US State Department undersecretary, stated that Taiwan Semiconductor (TSM) has not yet been given any assurances that it will receive a license to sell US technology to Huawei, the Chinese multinational tech company.

“There’s no assurance whatsoever on that,” Krach told reporters about the potential license.

“I think roughly around 10-12% of TMSC’s business is China, and I think that is in essence almost primarily Huawei,” Krach said. “So they will be restricted unless they’re granted a license, and there is no assurances on that and we don’t anticipate that.”

On Friday the Commerce Department announced that companies would require licenses for sales to Huawei of semiconductors made abroad with US technology.

The requirement is intended to “prevent U.S. technologies from enabling malign activities contrary to U.S. national security and foreign policy interests,” Commerce Secretary Wilbur Ross said in a statement.

Also on Friday, Taiwan Semi confirmed plans to build a $12 billion plant in Arizona, which could produce as many as 20,000 silicon wafers a month. This is about 20% of the output of the chipmaker’s largest Taiwanese factory- and would create about 1,600 jobs for the region. The plant would be expected to begin production as soon as 2024.

“While it is hard to be certain, we believe that TSMC announcing a U.S. Fab could remove the threat of further Huawei restrictions in the very near-term at least,” JP Morgan analysts told investors following the announcement.

“This project is of critical, strategic importance to a vibrant and competitive U.S. semiconductor ecosystem that enables leading U.S. companies to fabricate their cutting-edge semiconductor products within the United States,” Taiwan Semi said of the new plant.

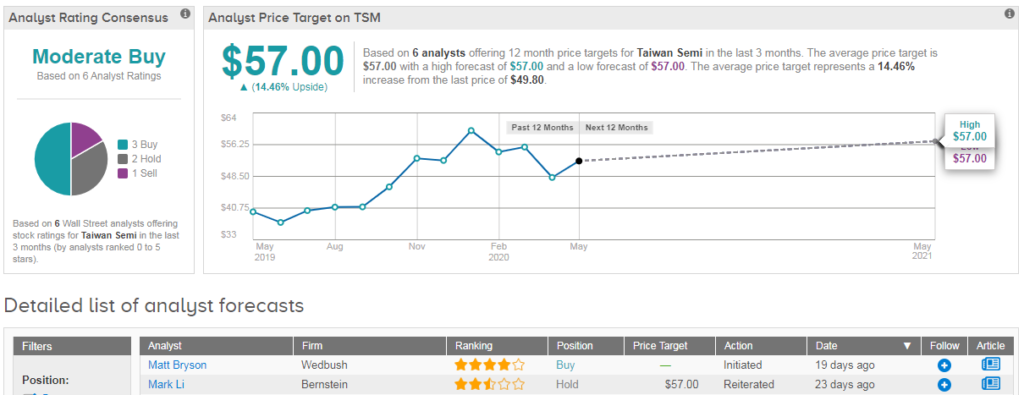

Overall TSM shows a cautiously optimistic Moderate Buy Street consensus, with 3 recent buy ratings, vs 2 hold ratings and 1 sell rating. Meanwhile the average analyst price target of $57 indicates 14% upside potential lies ahead. Shares in Taiwan Semiconductor fell 4% in Friday’s trading, bringing the stock’s year-to-date loss to 14%. (See TSM stock analysis on TipRanks).

Related News:

Intel, Taiwan Semiconductor Said to Be in Talks with Trump to Build U.S. Plants

Is Royal Caribbean Cruises (RCL) Stock a Buy? This Analyst Says Yes

Nike Warns Virus Store Closures To Have “Material Impact” On Q4