Baltimore-based global investment manager T. Rowe Price Group (NASDAQ: TROW) has announced that its assets under management (AUM) during the month ended December 31 rose 3.7% to $1.69 trillion. Notably, the figure includes $47 billion from the completed acquisition of Oak Hill Advisors in December.

Despite a sequential rise in AUM, shares of the company dipped more than 6.6% to close at $180.83 on Wednesday.

AUM in Detail

December-end total assets in the U.S. mutual funds portfolio increased marginally to $871 billion from $869 billion in November. Equity assets accounted for 64% of the portfolio, 27% were multi-assets, and the remaining 9% were fixed income and money market assets. Notably, equity assets remained unchanged at $554 billion in December compared with the prior month.

Total assets from other investment portfolios were $770 billion, up 1.4% from the previous month. Overall, equity and fixed income, including the money market, came in at $524 billion or 68% of the other investment portfolios, while multi-assets stood at $246 billion, or 32% of the portfolio.

T. Rowe Price reported a 1.8% sequential increase in target date-retirement portfolios to $391 billion from the $384 billion recorded in November.

Wall Street’s Take

Following the December AUM update, Jefferies analyst Daniel Fannon maintained a Buy rating on T. Rowe Price but decreased the price target to $218 (20.56% upside potential) from $245.

Overall, the stock has a Hold consensus rating based on 2 Buys, 4 Holds, and 3 Sells. The average T. Rowe Price price target of $208.11 implies 15.09% upside potential to current levels. Shares have increased 18.5% over the past year.

Risk Analysis

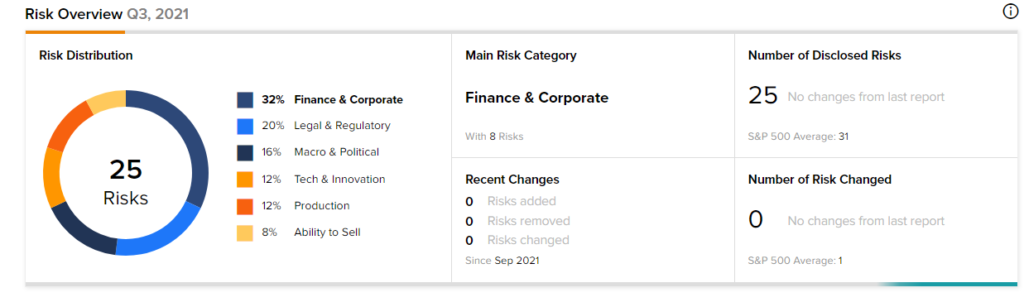

According to the new TipRanks Risk Factors tool, T. Rowe Price stock is at risk mainly from three factors: Finance and Corporate, Legal and Regulatory, and Macro & Political, which contribute 32%, 20%, and 16%, respectively, to the total 25 risks identified for the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Twitter Acquires Minority Stake in Aleph Group

U.S. Government to Purchase 600,000 Additional Doses of Sotrovimab; Shares Jump

CVS Health Expects Higher Earnings in 2021

Questions or Comments about the article? Write to editor@tipranks.com