T-Mobile (NASDAQ:TMUS) shares are under pressure today after the mobile communications services provider’s fourth-quarter EPS of $1.67 lagged estimates by $0.24. On the other hand, its revenue of $20.48 billion fared better than expectations by nearly $800 million.

During the quarter, TMUS saw 299,000 postpaid net account additions and 1.6 million postpaid net customer additions. Postpaid churn stood at 0.96% in Q4. Further, the company added 53,000 prepaid net customers. Prepaid churn for the quarter came in at 2.86%. Notably, TMUS increased its number of high-speed internet customers to 4.8 million with 541,000 net additions in Q4. The company’s total number of customer connections now stands at a record 119.7 million.

These metrics helped the company increase its total Q4 service revenue by 3% year-over-year to $16 billion, while its net income jumped by 36% year-over-year to $2 billion. Impressively, its adjusted free cash flow rose by 77% to $13.6 billion for the full year.

For Fiscal Year 2024, the company expects 5 million to 5.5 million postpaid net customer additions. Core adjusted EBITDA for the year is seen landing between $31.3 billion and $31.9 billion. Further, adjusted free cash flow is anticipated to be in the range of $16.3 billion to $16.9 billion in 2024.

What Is the Target Price for TMUS?

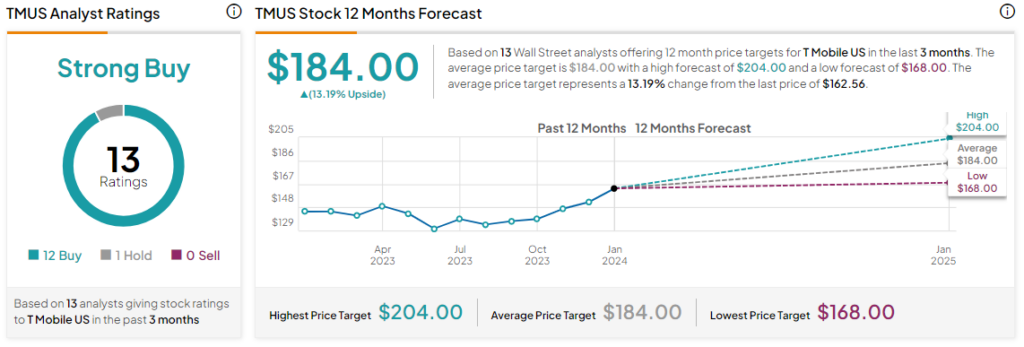

Overall, the Street has a Strong Buy consensus rating on T-Mobile, and the average TMUS price target of $184 implies a modest 13.2% potential upside in the stock. That’s on top of a nearly 14% jump in the company’s share price over the past six months.

Read full Disclosure

Questions or Comments about the article? Write to editor@tipranks.com