Wireless services provider T-Mobile US, Inc. (NASDAQ:TMUS) has teamed up with Elon Musk-owned Space Exploration Technologies Corp. in a project to extend communication services in remote areas with no mobile connectivity. This project was announced by T-Mobile’s CEO, Mike Sievert, and SpaceX founder at an event held on Thursday in Boca Chica, Texas.

In a tweet, the SpaceX founder said, “Starlink V2, launching next year, will transmit direct to mobile phones, eliminating dead zones worldwide.”

The companies will use Starlink satellites (second-generation) as cell phone towers in space and T-Mobile’s bandwidth (the mid-band PCS spectrum) as connectivity sources to cover dead zones globally.

Initially, this experiment will be limited to T-Mobile users in Hawaii, the lower 48 states, Puerto Rico, Alaska, and remote offshore locations. This will equip the regions with services like text messaging, the use of some messaging apps, and MMS. Voice services through Starlink will follow later.

It is worth mentioning that the companies would require adequate regulatory permissions from the Federal Communications Commission (FCC) for their proposed initiatives.

What Is SpaceX Starlink?

Starlink is a network of satellites deployed in low Earth orbit by SpaceX. Starlink has nearly 3,000 satellites, which it uses to provide internet services globally.

California-based SpaceX wishes to launch another 30,000 Starlink satellites in the years ahead. The company is awaiting approvals from the FCC for the same. In addition to satellite communications, SpaceX has expertise in manufacturing spacecraft and providing space launch services.

Is T-Mobile Stock a Buy, Sell or Hold Now?

T-Mobile stock appears to be an attractive Buy for prospective investors. Analysts covered by TipRanks are unanimously optimistic about the prospects of this $184.4-billion company, which commands a Strong Buy consensus rating based on 15 Buys.

TMUS’ average price target of $174.53 represents an upside of 18.67% from the current level. Notably, the highest price forecast is $200 at 36% upside potential, while the lowest price target of $159 mirrors an 8.1% upside.

Shares of TMUS have grown 28.5% since the start of 2022. On Thursday, the stock gained 1.2% to close at $147.07.

The company’s growth story is also underpinned by a 24.35% increase in the total estimated visits (or up 62.69% for unique visitors) to the company’s website since the beginning of 2022. Further, quarter-to-date visits (total) have increased 19.83% year-over-year while advancing 58.84% for unique visitors.

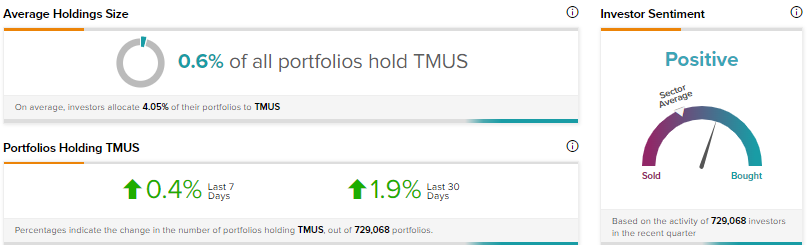

Financial bloggers are 85% Bullish on TMUS versus the sector average of 66%. Also, retail investors on TipRanks have a Positive stance on TMUS stock. They have increased their exposure to the company by 1.9% in the last 30 days.

Concluding Remarks

The success of this project would ensure proper mobile connectivity in the remotest areas of the world, even in times of natural disasters. Also, the companies’ desire to share their technology with other wireless service providers across the globe would be in the best interest of mobile phone users. For SpaceX, the success of the project would be a big win, while the same for T-Mobile would open gates for new sources of revenue.

Read full Disclosure

Questions or Comments about the article? Write to editor@tipranks.com