Synaptics Inc (SYNA) has signed a definitive agreement to buy DisplayLink Corp., a high-performance video compression technology company, for $305 million in an all-cash transaction.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Synaptics expects the deal to add about $94 million in annualized sales and be immediately accretive to non-GAAP gross margins, non-GAAP operating margins, and non-GAAP earnings post-close. The transaction, which is expected to close in the company’s first quarter of fiscal year 2021, will be financed from existing cash on hand.

DisplayLink’s high performance software compression technology enables universal docking and casting of high bandwidth video from any device to any display using any transport medium such as USB, Ethernet or Wi-Fi. For the enterprise IT market, the solution is applicable in multi-OS environments including Windows, MacOS, ChromeOS and Ubuntu Linux allowing for a myriad of devices to seamlessly dock to multiple high resolution (4K, 8K) displays.

“Several market trends such as work from home (WFH), bring your own device (BYOD) and office hoteling coupled with the growing need for multiple, high resolution displays in enterprises are driving demand for universal docking and casting solutions,” said Synaptics CEO Michael Hurlston. “DisplayLink’s track record of success and strong market validation coupled with Synaptics’ leadership in commercial docking solutions positions us well to capitalize on these trends and deliver compelling solutions to our combined customer base.”

The acquisition comes after Synaptics earlier this month announced that it snapped up certain assets and manufacturing rights for Broadcom’s (AVGO) wireless IoT business for about $250 million in an all-cash transaction.

According to Synaptics, the DisplayLink deal, in addition to the purchase of Broadcom’s wireless IoT connectivity portfolio, further boosts its long-term IoT diversification strategy. As a result, the company can deliver solutions that drive up to four 4K displays, adds support for emerging 8K/10K displays and the upcoming USB4 standard, and enables high-performance, dynamic wireless video docking and casting.

Shares in Synaptics rose 1.3% to $73 in after-market trading on Monday after advancing 2.5% at the close.

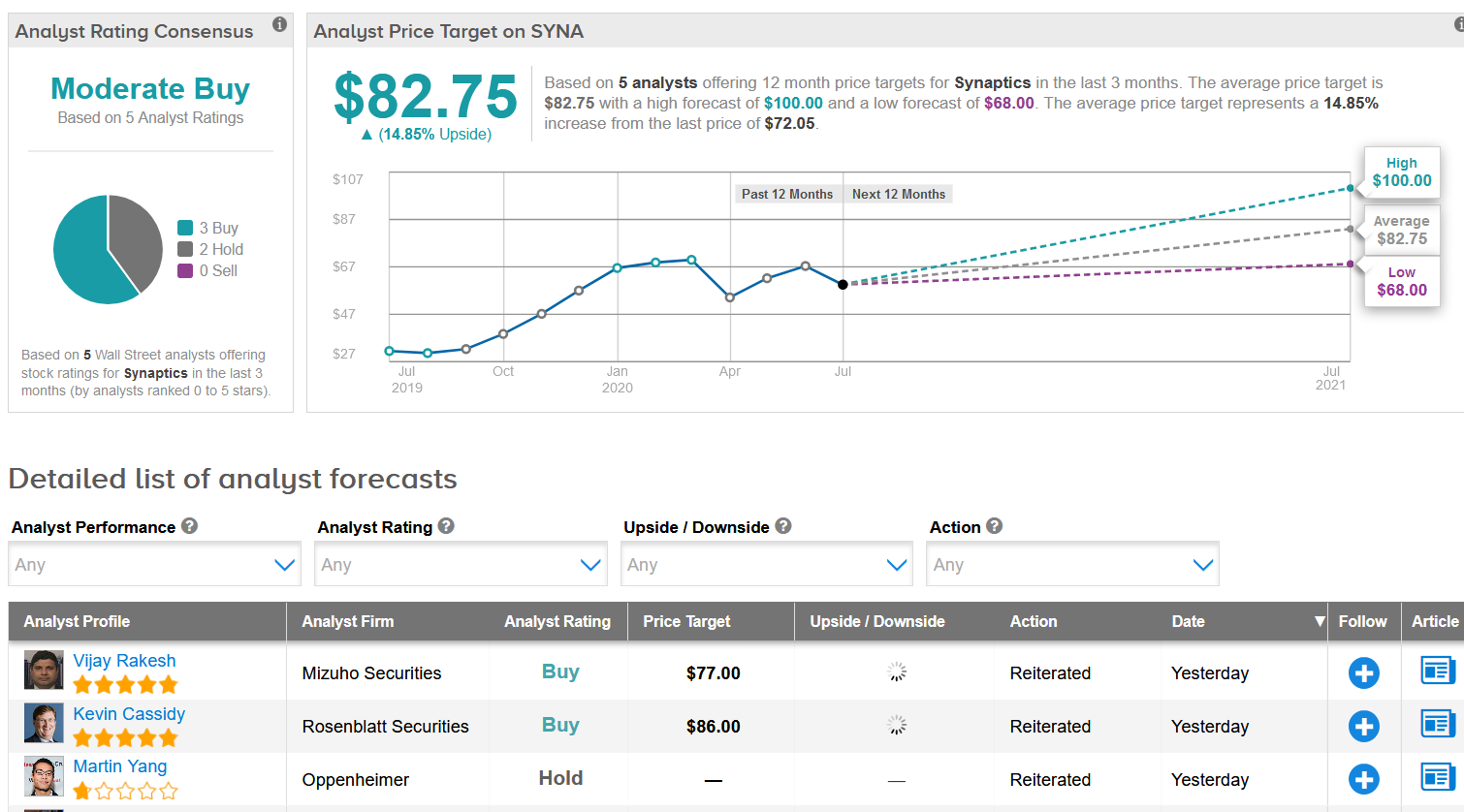

Following the news, Rosenblatt Securities analyst Kevin Cassidy lifted the stock’s price target to $86 (19% upside potential) from $73 and maintained a Buy rating, saying that along with the accretion bonus, he likes “this acquisition strategically for selling more product to Synaptics current PC customer base”.

“We see a growing market opportunity for wireless HDMI products with the combination of DisplayLink and Broadcom wirelss IoT products,” Cassidy wrote in a note to investors.

With the stock up almost 10% year-to-date, the $82.75 average analyst price target implies investors could be looking at 15% upside potential in the shares. Overall analysts have a cautiously optimistic Moderate Buy consensus on Synaptics.(See Synaptics stock analysis on TipRanks).

Related News:

IBM Pops 5% in Extended Trading After Quarterly Profit Beats Expectations

Amazon Exports From India-Based Sellers Crosses $2B Mark – Report

Apple iPhone SE Boosts Q2, But Unlikely To Cannibalize 5G Sales – Report