Symbotic (SYM) stock cratered 35.9% yesterday on news of financial misstatements and a delay in filing the company’s 10-K report for the Fiscal Year ending on September 28, 2024. The Walmart (WMT)-backed company restated its quarterly accounts for Fiscal 2024 and released the same on November 18. Additionally, Symbotic said it needed time to review its accounts for material weaknesses and revenue recognition errors, which impacted figures for Q2, Q3, and Q4.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Symbotic is a warehouse robotics company and a provider of artificial intelligence (AI)-enabled solutions to big box retailers, including Walmart. Interestingly, Walmart has a majority stake in Symbotic. Also, Softbank (SFTBY) has a notable stake in the company.

Some of the errors found were related to recognizing goods and services being expensed before they actually hit the specific milestones, resulting in cost acceleration. Also, mistakes related to some cost overruns on billable deployments were found.

Impact of Errors on Symbotic’s Financials

According to early estimates, correcting these errors could reduce system revenue, system gross profit, income/loss before tax, and adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) by $30-$40 million. In the earlier release, Symbotic reported revenue of $577 million, net income of $28 million, and adjusted EBITDA of $55 million.

The revision also led to a lowering of the guidance for Q1 FY25. The company now forecasts Q1 revenue in the range of $480 to $500 million, down from the previous guidance of $495 to $515 million. The Street expects revenue of $503.6 million. Adjusted EBITDA is now projected between $12 and $16 million, down from $27 to $31 million.

The company has vowed to implement strategies to improve internal control of financial reporting. The company aims to file its revised 10-Q for Q4 and annual report within the 15-day extension period granted for late filings. Symbotic also said that it will be amending its current report, stating that the results released on November 18 should not be relied upon.

Notably, Symbotic has a pending class action lawsuit against it that alleges that the company misled investors about its gross margin potential in Q3 FY24 and beyond.

Is SYM a Good Stock to Buy Now?

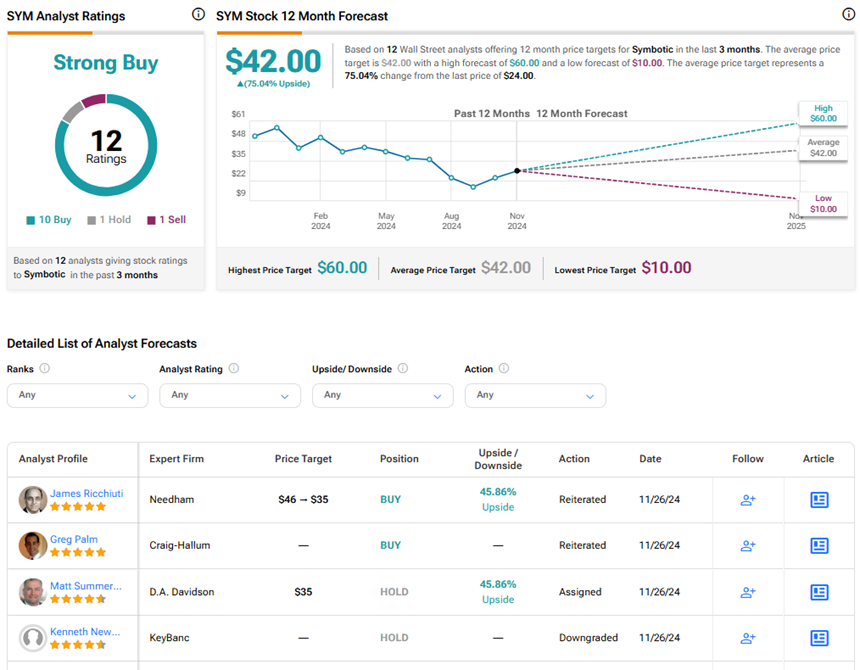

Based on the ratings received in the last three months on TipRanks, SYM stock has a Strong Buy consensus rating. This is based on ten Buys versus one Hold and Sell rating each. The average Symbotic price target of $42 implies 75% upside potential from current levels. Year-to-date, SYM stock has declined 53.3%.

These ratings could change if analysts revisit their recommendations following yesterday’s announcement.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue