For the first time in history, notes a report from the International Energy Agency, investment in solar power will actually surpass investment in oil production. That’s a big deal, though admittedly, it hasn’t done much for several solar stocks‘ performance in Thursday afternoon trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

It’s a narrow win, granted, but a win nonetheless. The International Energy Agency notes that investment in oil production will total around $370 billion. But solar investments will surpass that by $10 billion, coming in at $380 billion. The combination of subsidies and tax incentives is getting more people interested in solar power and making investments accordingly in a field that’s starting to look more viable with each passing day. And the ratio is improving; five years ago, solar and oil reached parity. Now, for every dollar invested in fossil fuels, $1.70 is going into clean energy.

Certainly, fossil fuels will have a place at the table for years, if not decades to come; OPEC recently called IEA’s request to pare back oil investment as a move to “…undermine global energy security and economic growth.” Nevertheless, investment in fossil fuel supplies will increase by 6% this year alone.

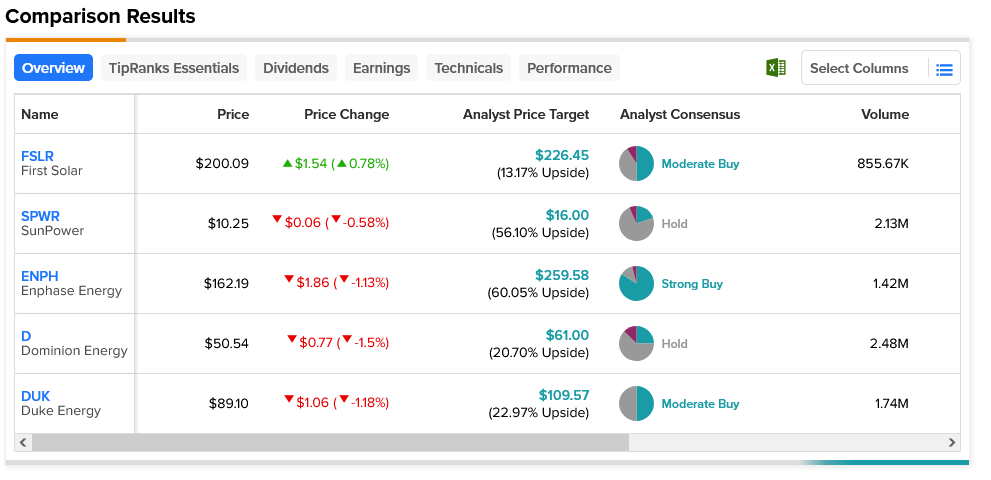

As for solar stocks, the revelation of increased investment didn’t fare well for many. First Solar (NASDAQ:FSLR) notched up slightly and was the only one of five major solar stocks to do so. It’s considered a Moderate Buy by analyst consensus, and with an average price target of $226.45 per share, it offers investors 13.17% upside potential. Meanwhile, Enphase Energy (NASDAQ:ENPH) offers the best upside potential. It’s considered a Strong Buy, and with an average price target of $259.58, it offers investors a 60.05% upside potential.